What is a blockchain?

A blockchain is a chain of blocks all tied together that provides information to the individual blocks in order of creation so that all participants know their state. Lately, you can't avoid the term blockchain. It is in the news more often, due to the fact that major coins like Bitcoin and Ethereum use it. So what exactly is blockchain and why has it become so popular? You'll know exactly that after this lesson.

Key indicators

✔️Blockchain is a decentralized and continuously available system in which information is stored and shared among multiple computers. without third parties, where the public database is immutable once captured.

✔️Blockchain is trustless because the system does not require trust between computers to achieve consensus. Instead, consensus is achieved by majority agreement (51%) among network participants.

✔️Blockchain is designed with security as a priority, resulting in inherent security through the consensus mechanism and cryptographic algorithms used.

✔️Validators or nodes are computers in the blockchain network that keep track of the state of the blockchain. Also known as Miners.

✔️Blockchain mining is the process of adding new blocks to the blockchain by solving complex calculations. It ensures security and immutability. This process uses the proof-of-work consensus algorithm.

Wat is blockchain?

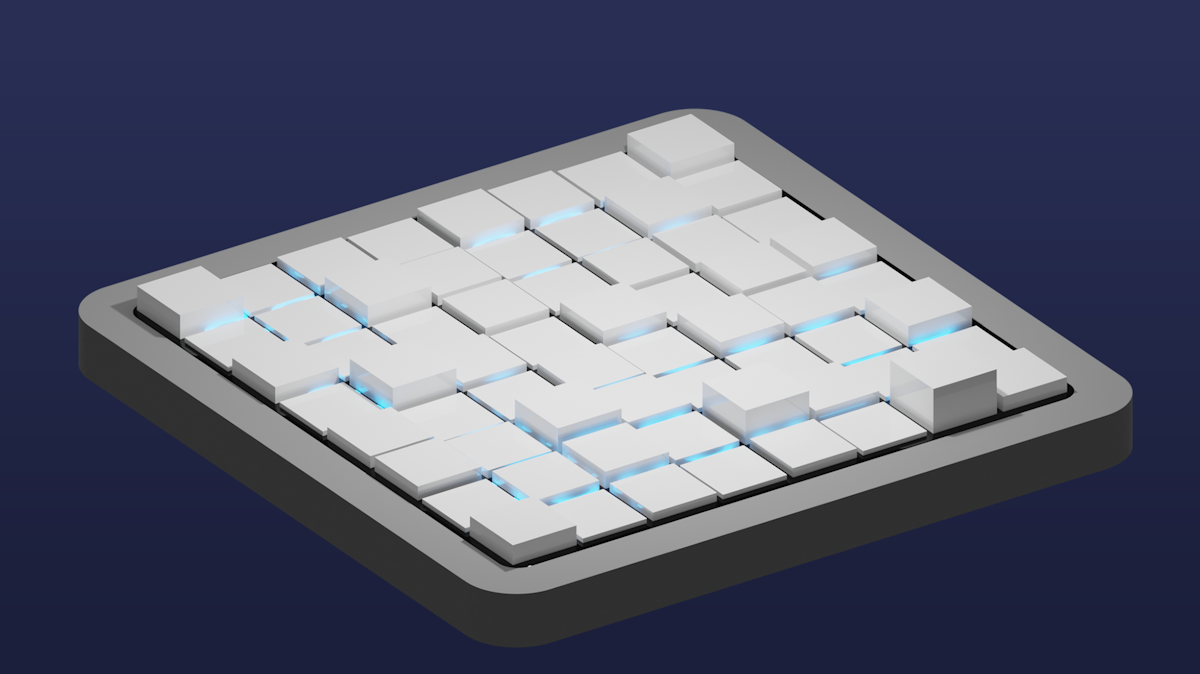

A blockchain is a chain of blocks linked together in a fixed order. You can best imagine this as blocks directly connected by an interline.

All these blocks together make up the blockchain. Each block contains information that is stored in a distributed database.

In other words, each block is sent to every computer that maintains the ledger, or database. A blockchain is always online, as long as one computer keeping the network is still online.

Trustless and decentralized technology

Blockchain technology is trustless, meaning that computers do not have to trust each other to agree on the new state of the blockchain. Once a majority has reached consensus (agreement), a new block is added to the blockchain.

No third parties to rely on occur, the database is publicly viewable and immutable after capture. So it is a decentralized network.

If you connect your computer to the network, you can get a copy of that network and have exactly the same information about its state as the other connected computers.

Blockchain technology is called security by design because the security of the blockchain is programmed into the design.

Bitcoin blockchain

So, taking Bitcoin as an example, there are computers keeping track of the state of Bitcoin’s blockchain.

The information that is important, such as who all has Bitcoin and how much, what transactions have occurred and who owns new Bitcoins that have been mined, is all captured and shared with every computer on the network.

These computers are called validators or nodes, but are better known as miners.

Wat is blockchain mining?

A miner tries to solve a difficult math problem using the computing power of his miner and gets new Bitcoins and transaction fees as a reward. If he does not solve the sum, he is still a validator and thus maintains the Bitcoin network,

This is called proof of work.

Once more than 51% of validators agree on forming new blocks, it is added to the chain. This is a very strong protection because it significantly increases the cost of an attack over time

So with this, the blockchain has lengthened by one new block, and all computers connected to the network know this, because this has just been communicated via distribution.

Once a block is created, it cannot be changed. So this is very secure, since there is no central authority to reverse or change a transaction.

Who is the inventor of blockchain?

In 1983, American computer scientist David Chaum designed a blind encryption technique very similar to blockchain.

The idea of blockchain technology was first described in 1991 by Stuart Haber and W. Scott Stornetta, two mathematicians who wanted to implement a system where the timestamps of digital documents could not be tampered with.

A first attempt at a blockchain was made in 1992, but the technology was soon abandoned and in 2004 the patent on the blockchain expired.

Components of a block in a chain

Blockchain technology consists of a number of components:

The genesis block. This is the first block of a blockchain. It contains a hash (cryptographic algorithm) at the end with all the data of this block.

Next blocks. This contains at the beginning the hash of the previous block, forming the chain of connection. At the end is again the hash of the block itself. It also contains important information such as the digital signature of the person creating the block (miner) and any new data added along with this block such as transaction costs and the state of the ledger.

The hash of the whole. A kind of unique name calculated via a cryptographic algorithm.

Nodes or validators maintain the blockchain by sharing the new state of the network with the others.

How does blockchain work?

Example transaction on a blockchain

Let’s add a simple example. John from America wants to transfer 1000 XRP to Jacky in Indonesia.

This transaction is validated and approved by validators on the XRP network and within 1 second the 1,000 XRP are in Jackie’s account in the ideal case. If there are any intermediate steps, such as an exchange, it may take a little longer.

Blockchain is limitless and immutable

So a blockchain works without boundaries. The transaction speed depends on the blockchain over which you send currency. For example, XRP is very fast and cheap while Ethereum is still quite slow and often expensive.

Once the transaction is approved by the validators, all orders are collected and when a new block is created, it is entered into the blockchain and cannot be changed.

So where with a bank you can still return currency, with a blockchain you cannot. This is a big advantage for some people, such as traders.

Cryptography and administration on a blockchain

Once all transactions and newly currency have been entered, the new block is given an identification number, a hash. This also contains the identification number of the previous block and a digital signature of the person who created the block, along with a date and time.

This allows everyone to see (since a blockchain is publicly viewable) exactly what the state of the network was at a given time. If 51% (in most blockchains) of the validators agree with the new block, the chain is extended by 1 block and the new state of the blockchain is known.

Blockchain forks

Sometimes it is not entirely clear which chain is the correct one. Validators do not agree on new transactions, for example, because of duplicate spending. Some validators proceed with a different chain than most because they think that chain is the right one. This is called a fork.

If it is a hard fork we are talking about a split-off. Then suddenly two coins exist. Well-known examples are Ethereum Classic and Bitcoin Cash. The nodes did not agree on which blockchain was the right one and from a certain block some validators continue working on one chain and others on a second.

There may also be deviations from the main chain. Suddenly, branches of the main chain exist and there appear to be multiple blockchains. This is almost always resolved by most miners (51%) continuing to work on one of those chains and the other miners following suit.

The right chain is generally considered to be the longest. New blocks are then added to the longest chain by all validators. This is called a soft fork, where sometimes new rules are established by agreement of 51%, but where there is still only one chain.

Types of blockchain

Blockchain comes in all shapes and sizes. Some blockchain works with smart contracts and others use fiat money to create stablecoins.

Blockchain technology now has several applications that can be used in the real world.

There is also a difference between a public blockchain and a private blockchain.

Public blockchains have public ledgers that are visible to everyone, while private blockchains aim to shield your private data.

Blockchains that can work with a smart contract have become very popular since the DeFi hype. By far the most popular of these is Ethereum.

Blockchain even makes it possible to create a new coin as a joke, a meme coin, although some prefer the name shitcoin. A good example is Dogecoin.

Several blockchains also work with games, utility, governance, NFT, storage, databases, derivatives and a whole host of other use cases.

The nice thing is that these are accessible to everyone, generally speaking.

Advantages of blockchain

Safe.

Because 51% of the miners or nodes must agree on the next block in the chain, it is virtually impossible to attack a network unless you deploy large sums of money and computer technology. Usually this is not even cost-effective and also punishable in certain cases, so this happens very rarely. With centralized systems, such as banks, all it takes is one rotten apple in the basket and it’s hit.

Anonymous.

The ledger does keep track of how much each user has, but not who it is. Unless someone knows which private key belongs to which name, anonymity in a blockchain is guaranteed.

The middleman is eliminated.

A bank or other intermediary charges fees for everything, a blockchain only transaction fees, which are often a fraction of that. Moreover, blockchains are generally much faster to settle and you often have the funds sent from, say, America to Japan within seconds.

Transparency.

Anyone can see the ledger or ledger. This inspires confidence; the paper shredder is permanently fired.

Accessible.

Anyone can join a blockchain, unlike banks, for example, where you must first get permission to open a bank account. Consequently, this still takes far too long.

Many uses.

Blockchains are known for being useful in a lot of areas. They have no specific markets in which they are supposed to work, although there are specialized blockchains. The more useful a blockchain network is, the higher its potential.

Private property.

If you have the private keys to a cryptocurrency, it is truly your possession. No one can seize these coins and even if the whole world goes bankrupt, these coins will still be in your possession. You can store your assets in this way much more safely than in banks or exchanges.

Disadvantages of blockchain

Energy consumption.

Proof of work has quickly become infamous. The Bitcoin network uses as much energy as a country like Sweden.

Mistakes.

You make mistakes quickly in this world. This can cost you a lot of money. Send coins to the wrong network and you lose them. Lose your private keys or your seed phrase (you have to fill in if you lose your data) then you can lose everything. This does not feel very safe. Scammers also have all sorts of ways to trick you into making mistakes through phishing, for example.

What is blockchain used for?

Cryptocurrency.

Banken – CBDC (Central Bank Digital Currency).

Logistics - authenticity assurance via routing of a product.

Food - shelf life information.

Identification - instant and free confirmation of your identity without a central body.

Diplomas - decentralized database of all earned diplomas with no possibility of fraud and free to share.

Barcodes - precise information about a thing (IoT, Internet of Things).

Environmentally friendly - no paper required.

Healthcare - private blockchains, where patients get to decide who gets to read what from their records.

Sensors - devices and computers communicate with each other and transmit things like temperature, on or off or other measurable things. This allows you, for example, to store on a blockchain whether a bottle of wine was too hot for too long and unsalable. Or you can turn on the heating half an hour before you get home. Smart meters also belong to this group.

The future of blockchain

Blockchain has some very important applications, which certainly have not gone unnoticed. More and more applications will be added in the future. Consequently, it will not go away.

In fact, it is more than likely that it will become very big. This is because of the strengths that blockchain has, such as cheap, no middleman, transparent yet anonymous, and very high security.

Blockchain can be compared to the wave of industrialization and computerization, where people are being replaced by machines.

Smart contracts will also increasingly be used across industries because of their decentralized design without a third party.

Financial institutions and governments see the arrival of CBDC wagging their tail, although many will raise their eyebrows at this.

As adoption and acceptance multiplies, so will the market. Perhaps it will be a discovery that will change the world, just as the Internet did. Time will tell.