Bitcoin halving 2024

- 12 minute read

The Bitcoin halving of 2024 is just around the corner. Crypto hearts are racing and the sweet smell of prediction is in the air. What awaits the crypto market?

- Bitcoin halving is an economic event that causes Bitcoin to become increasingly scarce and worth more so far

- Miners only get half as many Bitcoins and have to stop when it is no longer economically viable to mine them

- The psychological consequence of halving is that people know that every time Bitcoin becomes worth much more after halving and FOMO and an influx of new money follows

- What can we expect from Bitcoin and altcoins in the coming time?

- What is the best time to invest in cryptocurrency given the upcoming halving of Bitcoin?

Table of Contents

- What is the Bitcoin halving?

- Why is there a Bitcoin halving?

- When is Bitcoin halving 2024?

- How will halving affect Bitcoin miners?

- What are the implications of Bitcoin halving?

- Bitcoin price prediction after halving 2024

- Alt coin prediction after halving Bitcoin

- Best time to invest ahead of halving 2024

What is the Bitcoin halving?

The Bitcoin halving is an economic event in which the reward for a new block on the Bitcoin network for miners is halved. This happens every 210,000 blocks, as Satoshi Nakamoto programmed into the Bitcoin code.

Miners are looking for the solution to a cryptographic puzzle and whoever solves it first gets the reward, new Bitcoins and transaction fees from past block time (ten minutes). In the beginning you could receive 50 Bitcoins per solution, then 25, then 12.5 and now we are at 6.25 block rewards. Logically, after the imminent halving, the rewards will only be 3,125 Bitcoins.

By 2140, the last Bitcoin will have been mined. However, by far the largest number of Bitcoins will be mined in the first 20 years, around 20 million Bitcoins. In the first few years already half were mined, from 2012-2016 a quarter, et cetera. In total, there will then be 21 million Bitcoins.

By this design, the prediction is that Bitcoin will become increasingly scarce. If demand then increases, the price has no choice but to go up. This is how markets of supply and demand work.

Why is there a Bitcoin halving?

Bitcoin was invented and created by Satoshi Nakamoto leading up to the 2008 financial crisis. Nakamoto didn't like the money system so he invented a cryptocurrency that would become more valuable as time went on, due to scarcity.

Banks just print extra money and make the rest of the fiat money worth less in this way. The opposite happens with Bitcoin. If a halving takes place, the number of new Bitcoins will become less and less, so at the price will more than likely become higher and higher.

As Bitcoin becomes more widely known and more people become interested in owning it, the market of supply and demand will take care of the rest.

Nakamoto wanted to turn Bitcoin into digital gold. Gold is also growing in value because it cannot be reprinted. He has succeeded so far, with the price of Bitcoin breaking records every 4 years.

Bitcoin's function does differ from that of gold. While gold is rather untradeable except when you digitize it, the purpose of Bitcoin is that you can trade with it without intermediaries like banks or other financial institutions.

Speaking of gold, the value of gold has increased a hundredfold since the 19th century. In the beginning it did not rise as fast, because there was still a lot of gold to be mined. So the comparison is not so strange. So it's safe to say that if Bitcoin is headed in the same direction its value might also spiral upward. Mentioning Bitcoin's rate of increase is of course nonsensical as a comparison because Bitcoin started at virtually 0.

When is Bitcoin halving 2024?

The next Bitcoin halving will occur when another 210,000 blocks have been mined since the previous BTC halving from May 2020. It doesn't really come down to a day, but more than likely it will happen sometime in mid-April 2024.

How will halving affect Bitcoin miners?

We will first present general considerations.

Bitcoin miners search for the solution to a very difficult cryptographic puzzle. If they find the solution, they get to create the next new block, in which both the new Bitcoins are coined and the transaction fees of the past time are brought in. Per about ten minutes, 1 block is created on the Bitcoin blockchain.

When you are mining Bitcoin you have to deal with costs and benefits. The equipment you need to do this is very expensive. The cost of electricity also goes up a lot. Still there is a very high hashrate on the Bitcoin network, making the difficulty of finding a block enormously high.

In countries where energy is expensive, miners have long since given up. Professional miners buy increasingly expensive hardware, as well as entire factories that have a single function: to mine as much Bitcoin as possible at the lowest possible cost.

Once you get only half the Bitcoins per block found, your income goes down by about half. So the days of the professional single miner are pretty much over. You see an increasing concentration of hashrates at mining pools, which set up huge installations and also use the hashrate of individuals, who get a pro-rata return on contributed computing power.

If costs stay the same and revenues are cut in half, there are only two possibilities. Certain miners quit because it is no longer profitable, or the price of Bitcoin must at least double to keep the miner afloat. The latter is still happening every time after the halving.

If many miners quit, the difficulty will drop again, but it will likely be quickly filled by increasingly professional mining pools in locations with cheap energy in an efficiency round.

What are the implications of Bitcoin halving?

The implications for miners are clear. There will also be fewer additional Bitcoins on the market.

Bitcoin is the market maker and the market leader. When Bitcoin rises in price, other coins rise with it. Hail to the king, baby!

However, there is also a psychological consequence. At the previous halvings, the price of Bitcoin went up every time. This was followed by a bull run in which both Bitcoin and altcoins skyrocketed.

There is then soon talk of Fear of Missing Out. People want to make money and not miss the boat. This increases the demand for Bitcoin. Because there is increased demand, at some point there will no longer be Bitcoin to buy at lower prices, but there will still be Bitcoin to buy at higher prices. The market is going to do its job.

As Bitcoin rises, so will other coins. Because coins are also sold in pairs, there is always correlation between Bitcoin and all other coins. Moreover, otherwise Bitcoin would allow you to loot the altcoins and fortunately this does not work that way.

At some point, more and more people will get in when they see that prices keep rising. Even the corner barber will step in. This makes demand so high that prices have to rise. Once the corner barber steps in, it is time to become very careful and protect your money. This is because after the corner barber runs out of people who can still get in, demand decreases and the price can only go down!

"Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can't buy what is popular and do well."

Bitcoin price prediction after halving 2024

5 million! Just kidding. Surely we will have to explain this somewhat.

A quick trip down memory lane reveals that other Bitcoin halvings can serve us as points of reference, without, of course, any certainty, as it remains cryptocurrency, where certainties do not exist. What happened in previous Bitcoin halvings?

2012

It is November 28 in the year of the Lord 2012. Bitcoin is experiencing its first halving. Its price flew from 20 euros to 500 euros in the bull market that followed. Miners were still getting as little as 25 Bitcoin per "hit." By the way, Bitcoin came from 0 in 2009, so you can take these percentages with a grain of salt.

2016

The second of the halving events, July 2, 2016. Bitcoin price rose to €16,500 and miners got another 12.5 new BTC.

2020

Halving May 12, 2020, 6.25 Bitcoins per hit and the price rose to €60,000.

2024

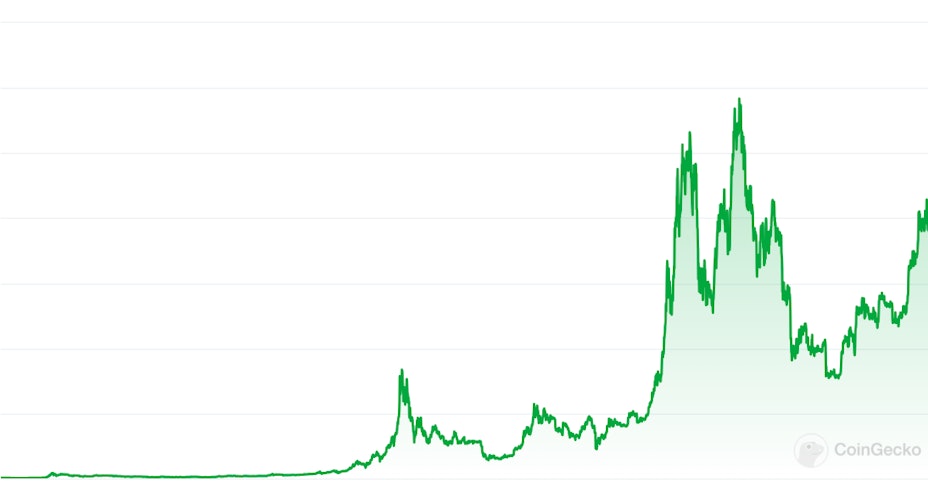

This is predicted to take place around mid-April. 3.125 BTC per block found. The price? First, a chart:

Source: CoinGecko

Looking at it this way, you might think Bitcoin is rising faster and faster. However, the opposite is true. The price of Bitcoin is rising slower and slower, while fewer are being added.

In the month of halving, Bitcoin's price rose every time so far.

After the first halving Bitcoin went x25+ relative to its All Time High, after the 2nd x33, after the 3rd x4 and what will its next move be? We take its ATH as a starting point and that is around €60,000. How fast will demand rise for Bitcoin in the coming bull market? Are people even willing to pay more and more for Bitcoin?

The curve is leveling off, so we may be moderately positive after the halfway point. Miners must be paid or they will quit. Moreover, there is still a bull market every time followed by a halving.

If we assume that there will be another bull market and the curve continues to flatten, then I can quote a reasonable amount, although this is not only coffee-gazing, but also redundant. You could fill in this number yourself in this paragraph, experts in technical analysis predict between €100,000 and 200,000 by 2025-2026. Since it is cryptocurrency and anything is possible in this world you may not have much use for it, but it is a reasonable target point as far as I am concerned.

The crypto market seems to be maturing a bit and as the total market cap increases, the potential growth will decrease because this money will have to come from somewhere. Still, there is more than enough margin for growth when measured against the world's GDP. Bitcoin sits around $1,000 billion capitalization and the world at hundreds of thousands of billions.

If multiple Bitcoin ETFs however, capitalization can increase rapidly. After all, institutional investors and large investment funds have deep pockets.

The figures mentioned are not overly positive, but not too negative either. All I can say about it is that I am taking this scenario into account. I have also been looking into my coffee grounds and in them I saw mold. What that means for Bitcoin I don't know, though it is true that from time to time you have to replace these things.

Alt coin prediction after halving Bitcoin

By altcoins, we mean any coin other than Bitcoin.

In a bull market, it is common for altcoins to rise more strongly than Bitcoin itself. This sounds peculiar, but Bitcoin already has a lot of money in it. To increase its value, many people would have to put a lot of money into Bitcoin.

The market capitalization of altcoins is usually much lower. Therefore, it is also reasonable for altcoins to rise more, because an investment in a coin with less capitalization simply has more price impact.

In the previous bull run after the halving, we saw Ethereum take a huge leap forward and quite surprisingly maintain its price pretty well, roughly comparable to Bitcoin. Ethereum went from under 200 euros to 4000 euros and retained about half of that in the lean years after the bear market. A great achievement for a great coin.

Other coins sometimes did much better. Still, this does come with a risk.

The lower a coin ranks in market cap at CoinGecko, the higher the probability that it will fall significantly in a bear market. Whereas Bitcoin and Ethereum retain about half their value, other coins can lose as much as 90-95% of their value in a bear market.

Thus, if you invest in altcoins that are trading lower with the goal of earning more you will have to be very careful. If the timing is wrong you could see all your profits evaporate in a very short period of time.

Many people look at the 2018 market and the ATH that many coins reached there. Many coins will never reach that ATH again. So don't stare blindly at that, because early 2018 was a crazy time, when a lot of people poured into the market who knew nothing at all about crypto. There was a lot of earning and also a lot of losing back then. Crypto was totally hot for a while.

Still, it is tempting to invest in altcoins. At the current price of Bitcoin and Ethereum, you can't expect them to do x10 for a while, right? Anything is possible in crypto, but who is going to give 6 tons for a Bitcoin or 40K for 1 Ethereum?

With lower-rated coins, however, such a price increase is quite possible. We see it happen time and again with altcoins. Given the previous bull run, however, a word of caution is in order. In the spring of 2021, a black day took place for Bitcoin during a crash. Both Bitcoin and altcoins lost half their value in just a few hours! Bitcoin and Ethereum recovered from that, but the altcoins did not.

What may have happened then is that miners started selling their Bitcoin to cover increased costs. Once one large pool dumps its bag, other mining pools may follow. So this may happen again. That will have a substantial effect on the price of Bitcoin. After such a dump, there is often fear in the market. The end of the bull market can then follow quickly, as many people have no appetite for it after a big loss.

It certainly doesn't hurt to sell your altcoins when you've made hefty profits. That has never made anyone poor. Maybe you could have gotten more out of it, but a lot is also enough, isn't it? In any case, you should be more careful if you have invested in altcoins.

Best time to invest ahead of halving 2024

Until now, Bitcoin's price always rose in the month of the halving. So logically, it is best to already have your money in cryptocurrency at that time, otherwise you have to pay more and more for your coins and can make less profit.

Make sure you don't have to do everything at the last minute. Look carefully at which crypto portfolio you want to have and determine your crypto exit strategy .

The drums are drumming and the hi-hat will echo. I am preparing for a rock and roll party. How about you?