What is a good crypto portfolio?

- 15 minute read

What is a good crypto portfolio?

This is something that sets tongues wagging. Some swear by diversification, others by concentrating on a handful of coins and others believe that you won't get anywhere if you don't take the big gamble once in a while.

Yet there are some handles to be found that are so logical that you can hardly escape them. Let's dive into the world of percentages.

"Small percentages, big guys."

-Willy Vandersteen

- A good crypto portfolio meets logical characteristics

- Beginners should hold simpler portfolio than experienced traders

- General guidelines for a crypto portfolio

- How much and how long to invest?

- How do you build a portfolio?

- What are the profit opportunities?

- When do you sell the coins?

Table of Contents

- What is a portfolio?

- Build best crypto portfolio

- General guidelines for a diversified crypto portfolio

- How much money investing in crypto?

- Portfolio construction

- How long to invest in crypto?

- Odds of winning

- Where do you store the coins?

- Sell all the coins in your portfolio

- Final Considerations

- Disclaimer

What is a portfolio?

Pretty important question if you're going to read an entire blog about it. A portfolio is a composite of several items of a certain kind with a specific purpose, such as in this case putting together the most promising crypto portfolio possible with the lowest possible risk.

Build best crypto portfolio

There are no universally applicable rules for this. Still, there are pointers that help with good crypto portfolio management. Let's take a look at what possibilities there are.

What is a good crypto portfolio for beginners?

If you are just getting started with crypto investing, it is not advisable to make it too difficult for yourself. Cryptocurrency is very volatile and can be very intimidating. It has a long learning curve. Keep it simple in the beginning, until you know enough about the market to take some more risk.

For example, if you want to invest directly, you can buy pure Bitcoin or a mix of Bitcoin and Ethereum. These coins have been at the top for so long that they are not likely to collapse. These coins can also lose a lot of value, but they are likely to remain relatively valuable compared to many other coins that lose more value in bear markets.

Thus, many coins can lose 90-95% of their price from their All Time High, while Bitcoin and Ethereum remain stuck around 50%.

However, investing directly is not the best option. If you want to invest in cryptocurrency you will still need to know a bit about the crypto market. For example, you will need to know when Bitcoin and Ethereum are high and when they are low (only then should you buy). For this you will need to know their four-year cycle. You can do this by going to CoinGecko and studying the max chart of these two coins.

We have dedicated an article to this where you can find lots of information about crypto trading .

If you are going to start investing in crypto I think a article about scams also not a luxury to read through. And while you're at it and taking the matter seriously, also read through what the most common mistakes made by crypto traders are.

Advanced crypto portfolio management

If you are somewhat advanced, you may decide to buy your own portfolio. This is, of course, the most fun, but it is also incredibly difficult. Where do you start ?

If all goes well, you've already done quite a bit of research on opportunities and pitfalls in the crypto market. You know the four-year cycle, which has to do with the Bitcoin halving , and thus know when a coin is high or low. Since it is essential in crypto to buy low and sell high, you therefore need the patience to wait until a coin is low and then buy it, because then your chances of success are many times higher.

If you feel that this is the best time to get in, then the distribution of your portfolio comes into play. For this you will need to make personal trade-offs, but most importantly you will need to be able to keep playing. And for this you will have to determine calculated risks.

In CoinGecko you can see the coins ranked by market capitalization. But you can also see there how their full behavior is in multi-year cycles by clicking on max chart. The consideration that is essential when deciding which coins to include in your portfolio has to do with this cycle: how plausible is it that the cryptocurrency I want to buy will still be this high by the time I want to sell it?

For that, we need a real-world example. Suppose a coin ranked 7 in CoinGecko has only been running for a year. In that case, it could very well be in spot 300 in a year's time.

Suppose a coin that is in spot 7 in CoinGecko has been running for 10 years. It is more than likely that it will still be there in 10 years. It has proven its worth.

The point of building your portfolio is to build a foundation of coins that have proven their worth. Most of your investment will have to be in top ten coins if you want to minimize risk.

A reasonable ratio of your portfolio is about 50/40/10. 50% you then invest in top ten coins, 40% in top 50 coins and 10% is "play money". That 40% you then spend on established top 50 coins (have a longer horizon than 4 years in CoinGecko) and 10% you spend on higher risk coins, for example emerging coins or "funcoins" like memecoins. Don't put the whole 10% into one coin, because then the fun can quickly be over.

This distribution is somewhat arbitrary, you could also gamble less or invest more in top ten coins, but this way you have an idea of how you could do it. The main goal of portfolio diversification is to have crypto that still has value in all market conditions, allowing you to keep playing this exciting game.

Overdiversification is pointless, research has shown, because of pair selling, where Bitcoin, for example, is traded against other coins. This always leaves correlation between the market leader and the other coins.

Something that is little taken into account is the focus on a submarket. Say you have a portfolio that includes only DeFi coins, then a downturn in the DeFi world could mean that your entire portfolio plummets significantly.

General guidelines for a diversified crypto portfolio

- Maximizing profit

- Minimizing loss

- Setting goals

- Setting purchase and sales prices based on cycles

- Buying coins that have proven reliable

- Invest money you can spare

- Buy different types of coins

- Take a little more risk with a very small percentage of your portfolio if you do it at all

- Choose a strategy and execute it tightly

- Be patient and disciplined

How much money investing in crypto?

There is only one rule: invest money that you never need. The reason for this is that if you ever need the money these coins may well be so low that you are left with heavy losses must sell, for example, to pay the rent or something.

So decide how much money you have left and what portion of it you want to invest. Think of it as money taken out of circulation until it has done its job.

Portfolio construction

All sorts of strategies have been invented to manage the construction of your crypto portfolio.

For example, you can work with Dollar Cost Averaging , where you put in the same amount every month, making the purchase price of coins both low and high, making it quite average.

You can also invest additional money periodically based on Technical Analysis. This is very tricky and recommended only for experts.

Some people just buy Bitcoin and do nothing else. They wait until this coin becomes worth what they want for it and then sell. This is called HODL and this might work very well for Bitcoin, as it spirals up in value. This is the most relaxed form of accumulation, where you can occasionally buy some extra Bitcoin if you happen to have some money lying around again.

In general, though, you can say that expanding your portfolio should depend on the period in a cycle the crypto market is in.

How long to invest in crypto?

This depends on personal considerations. Some people invest in crypto to achieve certain goals. For example, one person wants to travel the world, another wants to finance their children's studies and the next wants to become a millionaire.

All fine. The more expensive the goal, the longer your investment horizon should be. Of course, if you want to become a millionaire it will take much longer than if you want to take that trip, unless you are going to take insane risks that could both turn out very well and would end your adventure.

If you reach your goal then you can cash it all out or you can continue playing with what's left. The best part, of course, is if you can keep playing your whole life.

Odds of winning

If you are going to invest in Bitcoin and Ethereum, your chances of winning are lower than with any other coin, but your risks are also much lower. You won't get more x5 anytime soon with these coins, but doubling or slightly more is still possible. For that you will have to have a long investment horizon.

All other coins are a lot more volatile. That creates opportunities, but also risks. When Bitcoin rises, these coins often rise much more and vice versa. If you keep a close eye on Bitcoin and see where its bottom is roughly, you can buy altcoins at such times with the goal of making a high return.

If you then also buy coins that you can stake you can earn even more. For example, if you buy Cardano and stake it you can not only get a higher return than with Bitcoin and Ethereum, but also cash in the extra coins you earn from staking. As mentioned above, it is best to use coins with a longer presence than 4 years for this purpose.

The ten percent in play money you can possibly put into coins with a good team and strong technique with a low market cap. For this you will have to do a lot of research, as you could read in the linked article on this earlier in the text.

You can also stick them in emerging markets. For example, a while ago DeFi was hot. All you had to do was stick something in it or you'd have a mountain of profit in no time. Right now, AI tokens are popular. Almost always you have these kinds of hypes, where big profits can be grabbed. But such hype can be over tomorrow and then the losses quickly mount as well. In blockchain technology, there are always new practical applications that are not out of place in a diversified portfolio.

New coins can be found at CoinGecko under the heading "Cryptocurrencies" and then "New cryptocurrencies" in the drop down menu. Sometimes you can find a gem here that will make you a lot of money. Thing is, you have to do a lot of research for this or just get lucky with a meme coin or something. If you are investing in new coins you will not be allowed to have very high prediction.

For further diversification, you can also buy stocks or invest in commodities or precious metals. However, this is only advisable if you have the time, as crypto already takes up enough of your time. The advantage of this is that you are less dependent on the crypto market and can still make profits even if it is in a bear market.

"In the business world, the rearview mirror is always clearer than the windshield."

Where do you store the coins?

An often underexplored part of your crypto portfolio is where to store the coins. At Anycoin Direct, you can do this by placing them in the Vault or by putting them on a hardware wallet. We find these to be the most secure ways.

There are all kinds of cryptowallets . Some are more secure than others. If you store the coins on a DEX you are at great risk because you cannot use 2FA there. So you are only protected by a username and password. So be careful if and how much you store there.

Another possibility is on a crypto exchange. So given the debacle of FTX, you have to be careful here as well. Never store your crypto on obscure, unknown or new exchanges, as you never know if they are safe. Even larger exchanges can collapse, as we have seen. We advise against crypto trading here, but if you do it, stable them on an exchange with a very high standing, they cannot afford bad news.

Also write your seed phrase on, for when your hardware crashes or your phone is lost.

Sell all the coins in your portfolio

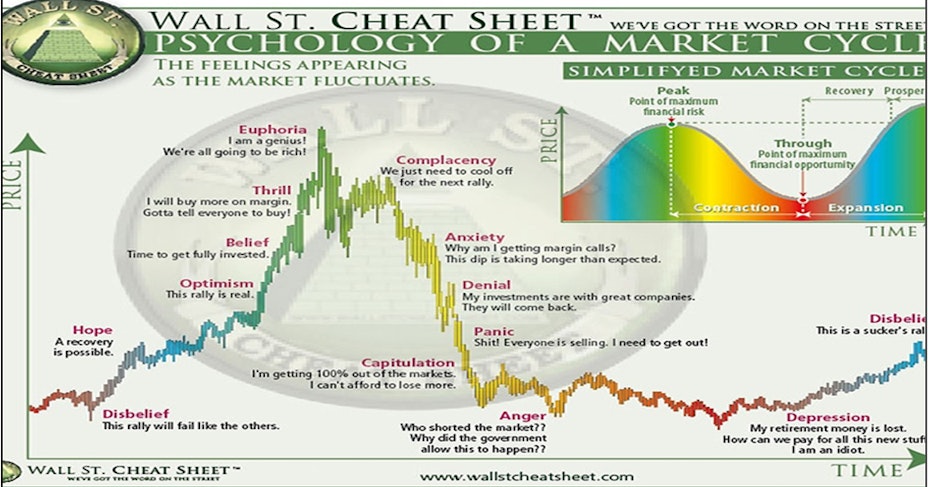

There will come a time when you will have to sell all your coins. To do this, you need to not only know the market cycle, but also follow your gut feeling. This is not easy. Nor is it a precise science.

As you now know, altcoins can lose as much as 90-95% of their value in a bear market and Bitcoin and Ethereum 50% or more. You really don't want to sit furiously behind your screen watching your investments lose value every day. You should have sold a long time ago, but how do you figure out when?

As you can see in the picture, markets almost always follow the same patterns. This has been true since ancient times with grain and rice markets, for example. It seems simple. You buy when you're at the bottom of the picture and sell when you're at the top of the picture. To keep it a little simpler for yourself, go to CoinGecko, take the Bitcoin max chart and see how its cycle goes.

After all, Bitcoin is the market leader and the rest of the coins run after it like meek sheep, because of its selling in pairs. You will soon pick out the cycles. Every four years, Bitcoin rises tremendously and in its wake the other coins. Altcoins rise much more in a bull market and fall much faster in a bear market.

The reason Bitcoin rises so much every 4 years has to do with Bitcoin halving. Miners then only get half the amount they used to get per mined block. If Bitcoin does not rise, mining is no longer profitable and they will stop. So far, Bitcoin has risen substantially every 4 years for this reason. It seems to me strong that this principle is ever going to change (although it is not impossible).

In between, you also often have 1 or 2 rebounds of Bitcoin, as you can see in the max chart. So in those times you can still grab profits in between.

The next big bull market is scheduled for about late 2025 (halving is in 2024) or early 2026. So before this one starts, you should have bought in all your coins so you can maximize your profits. However, this bull market may also start a little earlier or perhaps later. The previous one started in September 2020 and lasted just over a year.

To protect your portfolio from jet black days (in the previous bull market there was a day when coins lost up to 50% of their value in one day!) you can set a stop loss during the bull market with hefty margins. That way you protect the money, while still being able to make extra profits if the market goes even higher. You can then always put this stop loss further up if the market turns like a bull.

Another crypto exit strategy is to sell different crypto coins when they reach a certain price. This is simple and effective. This way you protect your profits without much fuss and you can sit back and relax and see if you could have gotten more out of it or made the right decision. After all, your profits have already been credited.

"Be fearful when others are greedy, be greedy when others are fearful."

By this Warren is saying that when the markets turn deep red it is time to buy heavily at the bottom. When the markets are spring green it is time to sell your crypto, if you sense that the top cannot be far off.

Final Considerations

If you have done everything right and built your crypto portfolio carefully, you may have to deal with additional events.

For example, politicians may ban privacy coins because criminals often work with them. So certain coins could be avoided if you suspect they could become a target for the government. Unregulated investment can be regulated later.

An economic crisis can also throw sand in the machine. Although crypto is much less sensitive to that. You may even find that your crypto becomes relatively more valuable in such a scenario.

If you have kept a close eye on everything and have been disciplined and patient, then that wonderful time will come when you will be rewarded with decent profits. Then you will remember what you did it all for.

Disclaimer

This is not buying advice. Always do your own research.