When are you a good crypto trader?

- 15 minute read

✔️ Good traders have important characteristics:

✔️ They act without emotion and do market research

✔️ They are not influenced by others and analyze their trades

✔️ They do portfolio management and buy coins that have proven their value

✔️ They are patient, disciplined and know the market cycle

✔️ They do time management and can adapt

When are you a good trader is a question many people would like to see answered. You are trading well, but somewhere you have the idea that you can do better. In this blog we will see if that nagging feeling can be put to rest and give you tips on how to become a better crypto trader.

Table of Contents

- When are you a good crypto trader?

- Bad traits of a crypto trader

- Good traits of a crypto trader

- What should you look out for as a good crypto trader?

- The market cycle

- Conclusion: when are you a good trader?

- Disclaimer

When are you a good crypto trader?

To get right to the point, let's start with the key question. Then we can also immediately disappoint you, or appeal to your reasonableness, if you prefer. What kind of trader do you want to be?

For this, we need an example. Suppose you start pacing when you have to wait 5 minutes for the bus. It is fair to say then that you are rather impatient. If you have this trait, would you want to trade with a 4-year horizon? Just sell your coins every bull market and then buy them in the bear market and keep them for another 4 years or so?

Ah, a light goes on for you. Yes, your personality should match your trading strategy. An extremely patient person can feel free to buy something and wait for hell to freeze over. An impatient person might be an excellent day trader.

On the temple of Apollo, it was already written: "Know thyself". Although they didn't have cryptocurrency back then.

So what you need to find out in the first place is what personality you have and what strategy suits it. If you do that beforehand, you have the potential to become a good trader.

If you know who you are, you "still have" to acquire some additional things, which is what we will talk about next.

Bad traits of a crypto trader

Do you want the good news first or the bad? Well, we start with the bad crypto trading traits, which can make your crypto adventure a nightmare:

- Trading with emotion. Oh no, that coin is going down in price. What should I do? Should I have put a stop loss order? I will keep the coins for a while, now they are going down again! I'll sell them now, otherwise I'll lose a lot more later! This is a typical emotional trading "strategy", in which gross mistakes are made. Make sure your strategy suits you, decide on a course of action before you buy and stick to the plan.

- Gather little information before you buy. If you know too little about a market cycle and the price of a coin you are buying, you are at the mercy of chance. Are you in a bull or bear market? Is the price of this coin high or low? Will there be a lot more of this coin soon? How can you make a plan if you don't know these things?

- Listening to others. No matter how smart an influencer is, or whether your crypto friend knows a lot about the market, you yourself need to know enough about a coin so that you can determine the buying moment. Influencers often own the coins they promote and are sometimes paid by commercial parties to shill a coin. Buy the rumor, sell the news. It is also fun to discuss the crypto market with your friends, but if you proceed to buy a coin you should have your own reasons for doing so.

- Portfolio management is not in order. Suppose you are very confident in one specific coin and it goes like a train, but in the wrong direction! Then you risk losing almost everything because you bet on 1 horse. In any case, try to own more than three different crypto coins so that you always have a solid foundation. Don't take too many coins in your portfolio either, otherwise you will lose track. Risk management is a very important factor.

- Invest money that you will need later, e.g. for rent. If the rent has to be paid with money invested in crypto, your coins might be so low that you can't even pay the rent or you have to sell at a big loss. Advice: only invest money you will never need. Then you won't panic.

- Not paying out profits. Many traders could have been quite successful if they took their profits from time to time. However, they decide to let their profits evaporate due to greed because they think the coin can rise even higher and often sell later at a loss.

- Investing a lot of money in coins that have no working product or hardly any use value, such as meme coins. These can silently disappear along with your money.

Good traits of a crypto trader

- Trade without emotion. You have made a plan and you stick to it. Even though that coin you have is going tremendously well, you have agreed with yourself that you take profits. You can also grab profits in portions, but you never let them evaporate. Also, people who have their emotions under control often put a stop loss, so that they don't incur much loss in case of a bad purchase. This way, you keep emotions at bay and trade with confidence.

- Do good market research. You know how a market cycle works and buy when coins are low and sell when coins are high. You know what a high and a low price is for a particular coin. You also know the roadmap of a coin, so you know if there are many coins to come or if there are big projects on the horizon at a cryptocurrency network.

- You don't let others influence you.

- You spread your purchases over several coins and invest in coins that have proven their value, for example coins that have been in the top 50 for a long time. Such coins don't disappear overnight.

- You invest money that you have left over and can therefore do without problems, if necessary for ever. That way, you don't put pressure on your investments.

- You don't invest large sums in coins that are just emerging or with no use value.

- Patience. You believe in yourself. After rain comes sunshine. When the going gets tough, a good trader will know that better times will come, because he knows the market cycle and does not buy weird coins, so his investments will automatically become worth more over time.

- Time management. If you have a busy family, day trading is not a viable option.

- Good traders use a trading book with results of every trade. This way, you can analyze things you have done and see what you are successful at and what you better not do again.

- Discipline. Define your strategy and stick to it. That way, you will not be distracted by all kinds of hypes and temporary successes of coins. Impulsiveness has already cost many people a lot of money in the crypto market. Discipline and patience are the best traits for a trader.

- Adapt. As soon as you see that certain things work better than others, good traders adjust their strategy. For instance, you can change from a day trader to a swing trader if that gives you better results.

- Goals. If you don't have a goal, like buying a house from your profits, or paying for your children's studies, you don't have a measurement point for success either.

We could mention many more, but you'll see the line by now. A good crypto trader has none of the bad and almost all of the good traits from these lists.

What should you look out for as a good crypto trader?

Let's start by saying that crypto trading is not that simple. You have to pay attention to a lot of things you don't easily think about. Especially beginning crypto traders quickly go wrong. Let us review some of the pitfalls.

Trading and storing coins

If you start trading crypto you will normally have to do so on a marketplace. There are quite a few of them.

Naturally, we recommend you do so at Anycoin Direct. At this crypto broker, you can easily store your coins in the Anycoin Vault or purchase them here and then store them in your hardware wallet. Moreover, our service is excellent, so you will soon feel at ease there. However, most traders trade on multiple platforms, so we will elaborate a bit more.

If you are going to trade on a crypto exchange and you are also going to leave your coins there you will need to pick an exchange that guarantees you that your coins are safe. After all, technically speaking, the coins listed on an exchange are owned by the exchange because they have the private keys . That doesn't have to be a problem, until you see that the exchange is corrupt or insolvent and collapses. Then you could lose everything that was on there.

You can also start trading on a decentralized exchange. This is not recommended for beginners, as you need to know a lot about all sorts of things. If you decide to start trading here, you often have to pay quite high fees, which you have to earn back first of all. When selling, you have to pay high fees again. Trading on Uniswap or Pancakeswap or any other DEX is therefore very expensive.

You can also buy coins and put them on a hardware wallet . This is the safest way to hold coins until you sell them. You are then in possession of the private keys and therefore fully own the coins you store. This, as already mentioned, is of course possible through Anycoin Direct.

Which coin is a good investment?

The best coins to invest in are coins that have proven their value. These coins have a lifespan longer than 4 years and have a more or less known price cycle. It is best to buy coins that are in the top 50 and stay there as long as they exist. This way, you can minimize the risk.

A coin that exists for a shorter time can suddenly start doing anything from mooning to collapsing. This is not a good base to build on.

Once you have chosen a coin, it is not a bad idea to go to their site and see the roadmap. For example, it might say on their site that they are going to double the number of coins in six months. Then suddenly your coins will only be worth half as much. Pretty important information, it seems to me.

Since you're going to get a bit diverse with your portfolio, you could, for example, invest 50% in top 10 coins, which have long been in the top 10, such as Bitcoin, Ethereum and XRP, 40% top 50 and 10% "play money". You can invest the play money, for example, in coins that you think could go up considerably, the so-called growth diamonds. You can read how to determine that through this link . All work and no play makes a trader a dull boy. Taking some risk keeps things a bit exciting, although then you can also lose the entire deposit of your play money. Therefore, you should put most of your money in coins with a solid foundation if you want to be a good crypto trader.

How much money will you invest?

This depends on your personal financial situation. If you have a permanent job and you have a lot left over per month, then it is a lot easier than if you have a temporary job and you have little left over.

Since you should never invest money you may need later you will need to build up solid buffers if you have temporary work. Don't forget that if you can't find a job for a very long time, for example, and no longer get unemployment benefits you will have to use up any money you have in crypto above around 5K before you can claim benefits.

Of course, you hope it never comes to that, but it is good to prepare for this kind of setback, otherwise you might have to sell your coins at the rock-bottom price because you have to pay the fixed expenses anyway.

So the firm rule is: invest money you will never need.

Which way will you invest?

If you have a lot of time, you can go day trading. Yet this is not always a good idea. For day trading you need not only a lot of time, but also iron discipline, a strong stomach and you must read a lot about it. If you are going to do this, it is best to work with small amounts at first, until you are confident in your abilities because of your results. A crypto course or a crypto master class on this matter is really not a luxury if you are going to invest with this strategy.

If you find this too stressful, have no time or this seems more interesting, you can go swing trading. Here, you use timeframes of days to weeks. For example, if you see that a certain cryptocurrency is sliding back and forth from 10 to 12 in a certain timeframe and back again, you can decide to buy such a coin around 10 and sell it around 12. This is already a much more relaxed way to invest.

You can also start investing in a coin. In this, you buy a coin and start holding it until it hits the price at which you have determined in advance that you will sell it. You can sleep easy with this strategy, because if all goes well you buy a coin low in this process and sell it when it is worth significantly more. The timeframe here is between months and years. You buy around the bottom of a bear market and sell around the top of a bull market if you get it right.

For information on the market, visit sites that track the crypto market, such as CoinGecko and CoinMarketCap. For deeper analysis, real-time stats and charts, you can use a site like TradingView. Especially for Technical Analysis, a site like TradingView is indispensable.

You can also apply the HODL strategy apply. Here you buy a coin and have no selling strategy at all. You hold that coin because you assume it will continue to rise and fall anyway, but that it will spiral in value over the years. The coin most commonly used for this purpose is Bitcoin. So far, these hibernators have been right.

For the experts, there is still technical and fundamental analysis. If you want to start working with the Ichimoku Cloud, the Bollinger Bands or a Moving Average, then technical analysis is really for you. As usual, though, you will have to read up big time on this heavy subject . Perhaps you will find an indicator that always gives you good results. After all, you did not spend all that effort for nothing then.

If you are short on time, you can also work with crypto trading bots. For a beginning crypto trader, automated trading is not recommended, because you have to set these things up just right. Fortunately, even with little money, you can start trading crypto and limit your risk. You can even do backwards testing with most trading bots, to see if your strategy has worked in the past.

There are other strategies, but these are the main ones. As mentioned, choose a strategy that suits your personality.

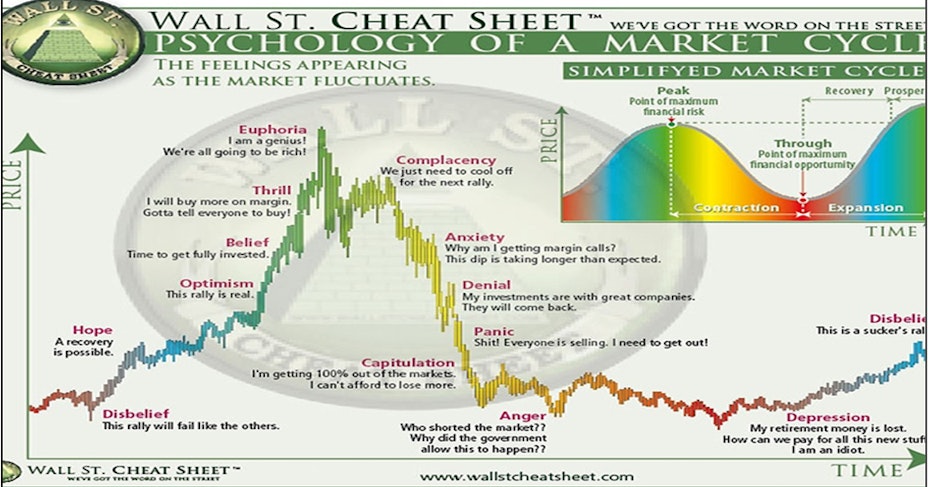

The market cycle

If you know the market cycle, you also know where you stand. You may not know the exact dates due to external factors, but you do know that the above cycle repeats itself over and over again. Every market with volatile items knows this cycle, even in ancient times this phenomenon existed, such as the grain or rice market.

If you know in advance how the market will evolve, you can also anticipate this. Warren Buffett, the legendary stock trader, said:

"Be greedy when others are fearful and be fearful when there is greed in the market."

This is a sophisticated way of saying you should take profits and buy low.

Quite a few books have been written about the stock market, which bears a solid resemblance to crypto trading, although the stock market is considerably less volatile. Read some of Warren Buffett's books, they are entertaining and will give you more insights into markets and buying strategies.

It is definitely not a bad idea to read all kinds of books on cryptocurrency and blockchain. The more you know about it, the more handles you will have as a crypto trader.

There is also a lot to learn on our site. We discuss all the highly-listed coins, we write blogs on a variety of topics and have an Academy , where you can dive deeper into the world of crypto and blockchain technology.

Conclusion: when are you a good trader?

You are a good trader when you buy a coin with the right intentions. There are many different reasons for buying a cryptocurrency.

For instance, buying a coin for 2 euros can be just as good or even better than buying it for 1 euro, provided you have a certain goal in mind. For example, if you are almost certain that a coin is going to hit 4 euros and you buy it to sell it for 4 euros, that is a fine strategy.

It is certainly better to buy it for 1 euro, but this could be the wrong choice if you want to swing trade the coin and it moves between 80 cents and 1.05.

All aspects have to be right in the light of your strategy. If you know what you are doing, you are much more likely to succeed.

Those who show more and more trading skills and fewer and fewer weaknesses will see this reflected in their results. If you then also start immersing yourself in the coins before purchasing them you will lay an increasingly solid foundation for success now and in the future.

This actually applies to everything in life, but we will mention it again delicately:

"The higher your knowledge and the more experience, the greater your quality."

To end it with a nice and appropriate quote, we let none other than inventor Thomas Alva Edison utter the famous last words of this blog:

"Many failures result from not realizing how close one was to success when one gave up."

Disclaimer

This is not buying advice, always do your own research and invest because you know why you do.