Has the new bull run started? Or is it a fake out

- 5 minute read

In recent months, Bitcoin and the rest of the market have grown very rapidly. The total market cap has increased by more than 53% in one year. Now the question is whether the upward trend continues and we can speak of a bull run, or whether we are dealing with a fake out.

Table of Contents

- What is causing prices to rise right now?

- Has the new bullrun begun?

- Possible bullish momentum for the crypto market:

- Possible bearish momentum for the crypto market:

- Conclusion

What is causing prices to rise right now?

The positive news surrounding Bitcoin and Ethereum ETFs has created positive market sentiment. The industry sees potential approvals of Spot ETFs as a bullish signal and this has caused barriers to be broken, more capital to flow into the market and the price of Bitcoin currently notes above €40,000. Just recently, it was shared that the 90% certain that Blackrock's Bitcoin ETF application will most likely be approved in January 2024 . The crypto market is waiting in suspense.

Has the new bullrun begun?

Determining whether a new bull market has begun is a long story. Consequently, opinions vary widely. The crypto market is therefore very unsettled and there is constant speculation as to whether a new bull run is underway. Prominent figures are making statements about their predictions. And we list some predictions for you:

Plan B

Plan B is a controversial market analyst who favors Bitcoin. He is the creator of the Stock-To-Flow model. This model is a prediction tool for the Bitcoin price that looks at several indicators, including the number of Bitcoins available on the market relative to the amount of BTC mined by miners and the Bitcoin Halving that happens every 3-4 years, causing supply to decrease over time while demand increases with healthy growth, which should benefit the BTC price over time. He recently published a YouTube video published in which, based on the Stock-To-Flow model, he expects BTC to reach a price between 15,000 euros and 60,000 euros before 2024. His substantiation in controversial, as his model predicted in 2021 that Bitcoin's exchange rate would be worth more than 92,500 euros. This prediction did not come true, as the exchange rate managed to reach "only" 64,000 euros.

Adam Back

Adam Back also expects Bitcoin's share price to rise hard in the coming months. He is one of the main developers of Bitcoin and is very bullish. He is convinced that Bitcoin will eventually become worth more than the physical gold market and predicts that Bitcoin will be worth more than 92,500 euros even before the Bitcoin Halving (which takes place in April 2024). After the Bitcoin Halving, according to Adam, Bitcoin will be able to reach a price of around 650,000 euros.

JP Morgan

One of the largest investment banks, JP Morgan, is a lot less optimistic about Bitcoin's share price. They see the Bitcoin price very collides with the gold price and expect that the Bitcoin price could rise to 42,000 euros in 2024. Given Bitcoin's current price of 41,000 euros, this prediction seems very conservative, given that 2024 also marks the Bitcoin Halving. More on the Bitcoin halving later.

Possible bullish momentum for the crypto market:

Bitcoin Halving as Starting Point for New Bull Market

We've said it several times in this blog. The Bitcoin Halving is important to the crypto market. Bitcoin Halving takes place every 210,000 blocks and halves the reward for mining a block, causing new Bitcoins to enter the market more and more slowly. This causes supply to rise more slowly in hopes of increasing demand, which will increase the Bitcoin price in the long run.

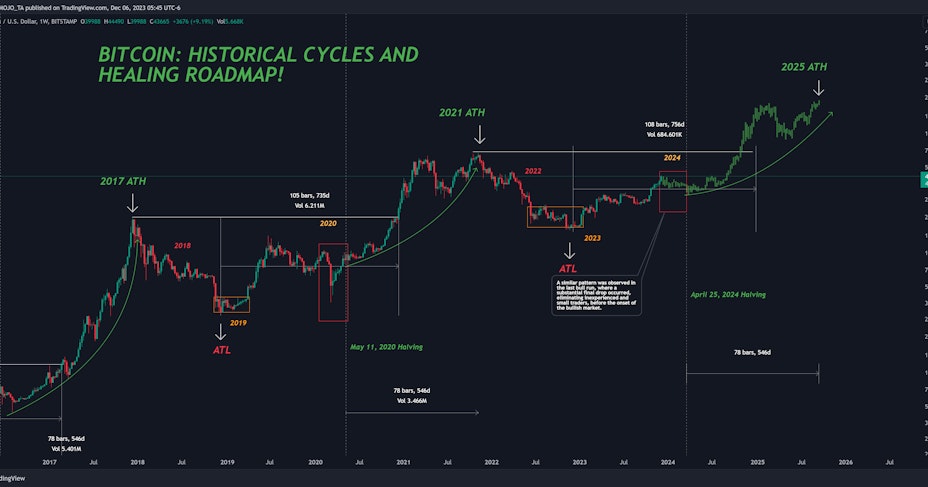

The next Bitcoin Halving will take place around April 2024, where the reward for mining a block will be halved to 3.25 BTC. If we look at the crypto market's past, we see that the market has always reacted positively to it so far. According to a technical analysis by a trader on TradingView the price rises after the Bitcoin Halving. Therefore, the Bitcoin Halving is often seen as the beginning of a new bull run.

Applying for approval of Bitcoin and Ethereum ETF

The adoption of Bitcoin and Ethereum ETF applications will also be able to have a bullish effect on the crypto market. Since some say there is a very real chance that Blackrock's Spot ETF will be approved in early 2024, this is certainly a time to keep an eye on. We have seen before that the applications alone led to huge price increases for Bitcoin, with Bitcoin's price currently up 160% from a year earlier. Never mind what awaits us if the Bitcoin ETF is approved.

Possible bearish momentum for the crypto market:

Negative news around Bitcoin and Ethereum ETFs could change sentiment

The market is still benefiting from applications made several months ago. However, the SEC led by Gary Gensler is still trying to put a stop to it. Despite the fact that approval seems a matter of time, the SEC is pulling out all the stops. The strategy: delay, delay and delay again. Should the SEC succeed in continuing to delay or even reject applications, the magic that has been created will slowly fade.

The SEC v. crypto providers

The SEC is also targeting crypto providers. In 2023, they have been on the warpath, leading to numerous charges against major exchanges in the United States, including charges against Binance and Coinbase . Which has already led to, among other things, high fines for Binance and the resignation of Binance's CEO ''CZ''.

In addition, the perennial lawsuit against Ripple is still ongoing. Although the SEC is continuously suffering losses during the lawsuit against Ripple and the impact of charges against crypto providers seems to be waning, a success could lead to bearish scenarios for the crypto market.

Conclusion

In conclusion, the question of whether the new bull run has begun or whether it is just a fake-out is currently not unequivocal. There are both bullish and bearish factors influencing the course of the crypto market.

On the positive side, we see the optimism surrounding the approval of Bitcoin and Ethereum ETF applications, with the prediction that the approval of Blackrock's Spot ETF in 2024 could have a significant bullish effect. The positive market sentiment has already led to price increases and more capital inflows, with Bitcoin currently trading above €40,000. Predictions from individuals such as Plan B and Adam Back suggest further price increases, albeit with different prediction.

On the bearish side, the SEC's actions against crypto providers and the ongoing litigation against Ripple pose potential threats to the market. Negative news surrounding ETF approvals or successful execution of legal proceedings could cause downward momentum.

Bitcoin Halving, scheduled for April 2024 and considered a possible catalyst for a new bull market, as historical data indicate.

All in all, it is crucial to monitor market developments closely, given the dynamic nature of the cryptocurrency market and the many variables that can affect price direction.