Is Bitcoin dead? Analyzing the current negative sentiment surrounding the crypto market.

- 10 minute read

According to a state-run Chinese newspaper, Bitcoin is heading to zero. With Bitcoin being down 55% in 2022 and negative crypto headlines in the news, the crypto sentiment is experiencing a bear market as well. According to Google Trends, the keywords ‘Bitcoin dead’ reached an all-time-high search record in the month of June. Has the time finally come? Not really, as Bitcoin has been declared dead countless times. Some even suggest that the overwhelming negative sentiment is a sign that we have reached the bottom. Let’s take a look a closer look at Bitcoin and negative sentiment throughout the years.

Negative search record and Bitcoin obituaries

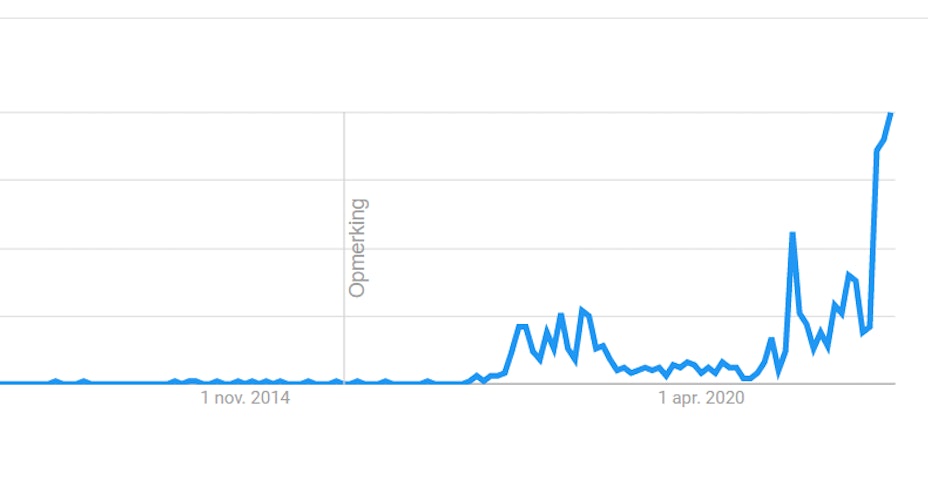

According to Google Trends, the words ‘Crypto is dead’ and ‘Bitcoin is dead’ have both reached search records. It seems that the price drop and negative news has caused a lot of people questioning whether Bitcoin’s price will go to zero. The Google Analytics data confirms this trend:

The previous search record was in 2018, when the price of Bitcoin dropped 65% from 20k to 3k . It seems that cycles of boom and bust also apply to search results on Google. Looking at the peaks between 2018 and 2022, the terms ‘Bitcoin is dead’ pop up after the price of Bitcoin drops.

However, history also shows that the night is darkest before the dawn, as these three peaks were followed by a new boom cycle. Every single time. When negative sentiment hits an all-time-high, the cycle of boom is just around the corner. Coincidentally, as negative search words are trending, phrases like ‘Bitcoin’ and ‘Bitcoin is it time to buy’ also reach higher search trends than before. At least in the year 2022. This is a rather interesting phenomenon, as normally a large increase in search results of the phrase “Bitcoin” was correlated with record prices and ATH’s for the largest cryptocurrency. With last week’s declines, search interest in the phrase “Bitcoin” rose from 19 to 51.

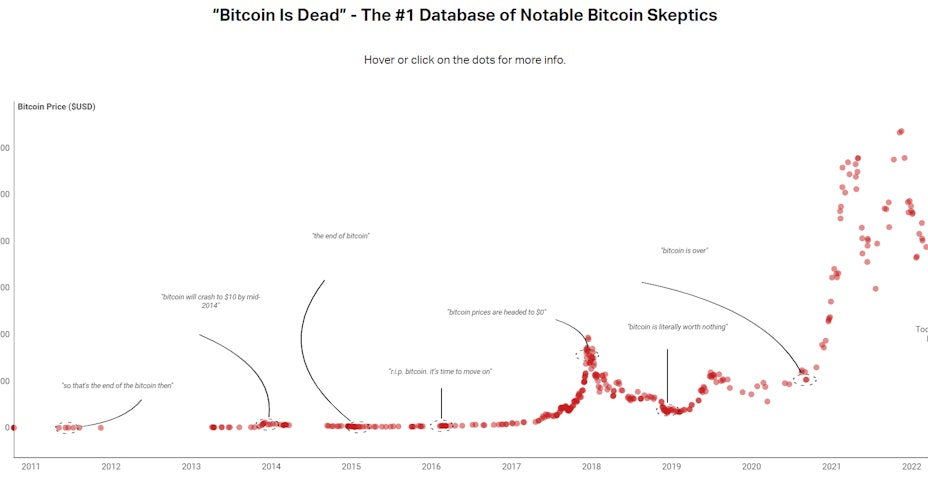

Bitcoin has been declared dead numerous times. As a matter of fact, the website ‘Bitcoin is Dead’ has been keeping track of all the times that Bitcoin has been declared dead. They call themselves The #1 Database of Notable Bitcoin Skeptics. On the website you can take a look at all the articles (starting in 2010) that have stated that the end of Bitcoin is near.

Bitcoin's story cannot be told without the inclusion of both its strongest believers and disbelievers. Healthy skepticism of revolutionary technology is vital because it speeds up development and adoption.

Jerry Feng - Creator of BitcoinIsDead

China and the Bank of England on Bitcoin

After enforcing citizens a ban on crypto mining, China’s crusade against digital currencies continues. State-owned newspaper The Economic Daily published an article where they warn people to not buy any crypto, saying that it will go towards $0 in the foreseeable future. They added that the West is to blame for the current status of cryptocurrency, without giving any examples of why this is the case. The newspaper stated:

"Bitcoin is nothing more than a string of digital codes, and its returns mainly come from buying low and selling high,"

The Daily Economic

The Bank of England has not been very positive regarding cryptocurrency in the past but has taken a bit of a turn lately. Jon Cunliffe, Deputy Governor at the Bank of England has stated that the crypto sector and technology behind it have huge applications and potential within the financial sector. He also mentioned that whatever happens during the bear market, crypto technology and finance will continue as it could bring huge efficiencies and changes in the financial market structure. At the Point Zero Forum in Zurich, Cunliffe made a comparison to the dotcom boom where a lot of invested money was wiped away, but as companies went the technology remained. Jon Cunliffe went on and said that those that survived -- the Amazons and the eBays -- turned out to be the dominant players.

De Bitcoin-fundamentals

Let’s not forget that stocks have been steadily declining in 2022 and that inflation has caused a lot of economic consequences as well. Sometimes it is important to see things in perspective. So instead of looking at sentiment, we are going to take a look at the Bitcoin fundamentals and how they are currently performing. The Bitcoin’s hash rate, supply and other influential factors such as government regulations are important indicators.

Bitcoin hash rate

The hash rate is the total amount of computing power that is being used for the Bitcoin network. Hash rate is an important indicator regarding Bitcoin’s decentralization and security. According to Blockchain.com, the hash rate has been steadily climbing since last year in July. Meaning that since China’s mining ban, miners have picked up the pace again. The amount of computing power assisting to the Bitcoin network even reached an all-time-high on the 13th of June. Although the Bitcoin price has dropped, the interest in mining keeps climbing.

Bitcoin Supply and scarcity

The total amount of Bitcoin is finite, as there will only be 21 million bitcoins in the future. There are currently 19 million bitcoins in circulation, meaning that there are still 2 million left that will be minted. As time goes by, Bitcoin will be harder to obtain/mine. Combined with the fact that many Bitcoins have been lost (private keys that will never be found) and that institutional investors are adding more and more bitcoin to their balance sheets, means that Bitcoin will become scarce as time progresses.

Regulations

Throughout the years, cryptocurrency and Bitcoin have been met with criticism in governments all over the world. The stance on cryptocurrency has shifted multiple times. But as time and knowledge progressed, we can see that the attitude towards crypto is changing as more and more governments (with the exception of China) are embracing the technology behind it. Talks of central bank digital currencies ( CBDC’s ) are becoming common and certain governments like El Salvador have implemented full scale adoption. Frameworks on crypto taxes are improved every year and crypto ETF’s are being approved all across the world.

If Bitcoin and cryptocurrency are dead, it sure has not looked that way in the last twelve months from a regulatory point of view. A bear market follows a bull market and when new investors flood the market, uncertainty looms around the corner. A new cycle will come, even though the negative sentiment might seem overwhelming at the time. When in doubt, zoom out, DCA, or maybe take a break. The crypto market is not going anywhere.