Aptos, The Solana killer?

- 5 minute read

Aptos is a new layer 1 blockchain technology launched on October 18, 2022. Aptos should be a Solana killer because of the speed, the number of transactions per second, the fees, and the technology used. However, the launch of Aptos is already controversial, and many prominent figures have spoken out about Aptos. But what exactly is Aptos? And will it be a Solana killer?

Table of Contents

- What is Aptos?

- Developers & Investors

- Tokenomics

- Aptos vs Solana

- Controversial

- Price development of Aptos

- Conclusion

What is Aptos?

The Aptos blockchain (APT) is – according to the Aptos team – the most secure and highest scalable layer 1. On the Aptos blockchain, smart contracts can be programmed, and applications can run. Aptos is a competitor of Solana and therefore could be a Solana killer because it would have better features. But other projects such as Ethereum or the Binance Smart Chain could also experience competition from Aptos.

Aptos makes use of various technical features such as the use of the programming language 'Move', internal sharding, parallel execution and has developed its own Virtual Machine. The blockchain used delegated Proof of Stake (DPoS) as its consensus mechanism. This is similar to the traditional Proof of Stake algorithm, but differs in the way it is validated. Users of the network can vote, who gets to validate a block. As a reward, they get a share of the validation proceeds. Due to these technical features, the number of transactions per second (TPS) for the Aptos blockchain is 150,000 to 160,000. This is higher than the 65,000 transactions per second possible on the Solana Blockchain. This makes Aptos a more scalable blockchain than Solana.

During its launch, Aptos was soon offered on several major crypto exchanges such as Binance and FTX. An airdrop was distributed by Aptos to early participants of the network. A total of 20,000,000 APT were distributed among 110,000 participants. For different activities done by early adopters, different airdrops were done. The most distributed airdrop was 150 tokens. The 150 tokens airdrop was valued at around $1200 in the days following the launch.

Developers & Investors

Aptos was developed by Mo Shaikh and Avery Ching. They want to provide free access to a decentralized, scalable, and secure blockchain that anyone can use. Under Shaikh and Ching is a team of 300 researchers, strategists, designers, and engineers who have all worked on the Aptos blockchain. Shaikh and Ching themselves have worked at Facebook (Meta), Blackrock and the Boston Consultant Group. Aptos' team, like Solana's team, is based in Silicon Valley. It is partnering with Google to make the connection between Web2 and Web3 and seeking collaboration with other major tech giants.

At Meta, the team worked on the much-discussed cryptocurrency the Libra, which later became the Diem. Libra wanted to be the new global payment system that billions of people would use. It should have been a stable coin made up of a basket of other currencies (including cryptocurrencies) and financial instruments such as US Treasuries. This way, large fluctuations in the price of the Libra could be prevented. However, the Libra never got off the ground due to all kinds of regulations. Mark Zuckerburg even had to testify before the US Congress. The developers working on the Libra then started working on Aptos. They want to breathe new life into the Libra but now through a decentralized blockchain and token.

Two funding rounds have been completed to fund Aptos. During these funding rounds, 350 million dollars was raised. These funding rounds were led by FTX ventures. Venture Capitals that participated include Jump Crypto, Multicoin Capital, Binance Labs and the now bankrupt Three Arrows Capital (3AC). These funding rounds were even made before the Whitepaper was published. Apparently, there was a lot of confidence in the developers and the price forecast.

Tokenomics

APT is used to pay the transaction fees on the Aptos blockchain, to make decisions (governance), and to stake. APT has a maximum inflation percentage of 7% a year. This is reviewed and adjusted every period (epoch). The maximum decrease in the inflation percentage is 1.5% per year with a lower bound of 3,25% a year. The inflation percentage can therefore vary. This percentage is offset by the burning of APT tokens. All transaction fees paid on the network are currently being burned. As a result, tokens disappear from circulation. However, the burning of the transaction fees could be changed with on-chain governance decisions.

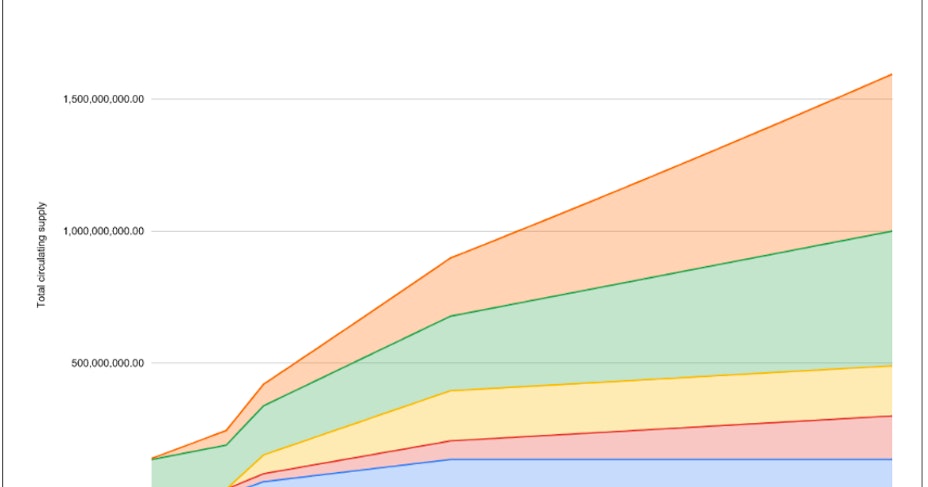

Aptos has a maximum supply of 1 billion tokens. These are distributed as follows:

- Community 51.02 % 510,217,359,767 Tokens

- Core Contributors 19.00% 190.000.000 Tokens

- Foundation 16.50 % 165.000.000 Tokens

- Investors 13.48% 134,782,640,233 Tokens

These coins are not immediately available. The tokens will be released according to following chart.

Source: https://aptosfoundation.org/currents/aptos-tokenomics-overview

At the end of 2023, the waiting periods for investors will expire, which means that the Aptos tokens will be released and can therefore possibly be sold. This will be an important moment for the price of APT. However, the release of tokens does not always have to lead to a price decrease, as this did not happen with Solana, for example, in the bull market of 2021.

Aptos vs Solana

In general, Aptos and Solana are very similar. They are both layer 1s where smart contracts can be programmed on. According to Aptos' Blockchain explorer, the average number of transactions per second is now 10 to 20, and about 20 million transactions have been made since the start of the blockchain. This is significantly lower than the possible 150,000 transactions per second. Solana, on the other hand, does between 100 and 200 million transactions per day. That is more than 2300 transactions per second.

The developed Virtual Machine based on the Move programming language could be an important feature that could make the Aptos blockchain a Solana killer. This is because it is very friendly to developers. That it is very friendly to developers was even admitted by the team at Solana. There is a fear within the Solana team that developers (and users) will move to the more user-friendly Aptos.

Solana has had a lot of problems with their blockchain over the past few months. The network was shut down and offline several times. Block production was stopped, and people were unable to transact on the network. This was partly due to DDOS attacks. Aptos wants to solve this by building a transaction market for every application on Aptos. This allows them to get ahead of the DDOS attacks, but will still maintain low transaction costs on the network. This would be an advantage over Solana.

| Aptos | Solana | |

|---|---|---|

| Consensus mechanism | Delegated Proof of Stake | Proof of History |

| Transactions per second (TPS) | 10-20 | 2300 |

| Potential transactions per second | 150.000 | 65.000 |

| dApps on the network | 20 | 350 |

| Programming language | C of Rust | Move |

Controversial

However, the Aptos project has already become controversial. For example, the fact that the aforementioned investment by Venture Capitals was done before publishing the whitepaper, is remarkable. Why should anyone invest in a blockchain if it is not yet clear how exactly this blockchain works or what the economy behind the associated currency is?

In addition, questions are asked about the token economy (tokenomics) of APT. Until shortly before the launch of the blockchain, there was no clarity or transparency about the tokenomics, even though many parties had already invested in it. Besides that, Aptos currently manages the 510 million tokens for the community. These tokens can be staked for which stake rewards could be received. These staking rewards are not locked and can potentially be sold on the market. This could have a negative effect on the market price of APT.

Price development of Aptos

The price of Aptos at its launch was around $15. Within hours, the price already dropped to around $6.60. So, it looked like those who had tokens at the launch soon started selling. The price stayed around this price for several days after which it started an upward movement of about 40-50% toward the $10 range. However, the price slowly decreased, and Aptos is currently trading around $7.5.

If Aptos is actually the Solana killer it aspires to be, a similar valuation of the project as Solana would be a possibility. Solana currently has a market cap of approximately $11 billion at a price of $31 per coin. Aptos has a market capitalization of approximately $1 billion. When Aptos is valued at the same valuation as Solana, or in the best-case scenario even above it, it could have a token price of around $70 with the current number of tokens outstanding.

Conclusion

Only time will tell whether Aptos is actually the Solana killer it promises to be and will receive the same kind of appreciation in the market. Despite technological innovations such as the developed Virtual Machine and the possible number of transactions per second, little seems to be happening on the blockchain at the moment. In addition, there has been a lot of criticism from the crypto community about various decisions made by the Aptos team. Whether the advantages are large enough compared to the Solana network and other blockchains remains to be seen. Much will still need to be developed to achieve the goal of the developers of Aptos: to become the blockchain that billions of people use every day.