Crypto bull market 2024

- 13 minute read

We've had the winter sweater on for about two years now since the last bull market. It was cold and boring. Occasionally a coin went to the Philistines or an exchange went south. Other than that, it was a bit of patchwork.

Can the sweaters now go into the closet and the T-shirts on? Is the crypto winter over? Let's take a look at the weather forecasts and, while we're at it, let's add our crystal ball. For the purposes of this blog, we will leave global warming aside.

- The strange behavior of altcoins is startling. Bitcoin rose from €15,000 to €40K. Altcoins kept moving sideways. Since early February 2024, this pattern has been broken

- In the past, you could generate hefty profits with altcoins as well as Bitcoin. We see no reason why this wouldn't be the case now, although then, the crypto market is unpredictable

- With the advent of multiple forms of a Bitcoin and altcoin ETF, a lot of money could flow into the crypto market, which could make the price of these coins worth considerably more due to increased demand for Bitcoin in particular

- Ethereum is working on a major upgrade that could boost its popularity and increase demand and price

- We are at the beginning of a market cycle, it seems. Sentiment is mostly optimistic and full of prediction. If prices start to rise substantially, it is highly likely that more people will get FOMO and also start to get in, which could cause the crypto bull market to pick up steam

- We will add our prediction, although then again it is only our humble opinion and anything is possible in crypto

Inhoudsopgave

- Has the bull market begun?

- Historic bull runs after Bitcoin halves

- Bitcoin ETF

- Ethereum Dencun upgrade

- Market Cycle

- Fear of missing out

- Prediction of crypto bull market 2024-2025

Has the bull market begun?

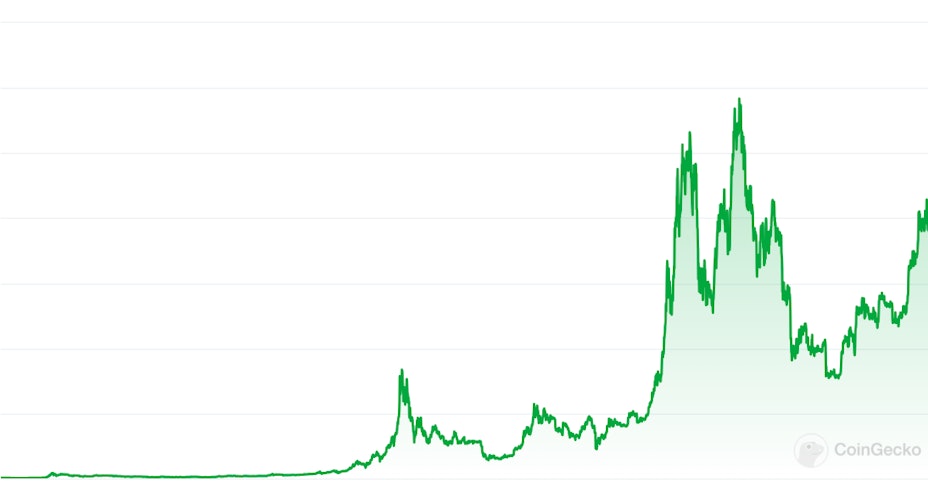

Source: CoinGecko

The Bitcoin chart shows us that we have been in a bull market for quite some time. Bitcoin has risen from just under €16K to over €58K. That's more than tripling its price. Still, it didn't feel very summery until the past few weeks.

How could that be? Well, during the time Bitcoin was gaining value, the altcoins were almost all sitting on their lazy butts. They didn't move from their seats at all. Bitcoin dominance skyrocketed because altcoins didn't rise most of the time when Bitcoin took another hit.

This has been changing since early February 2024. When Bitcoin rises now, other coins do rise with it. It's safe to say that it feels much more like a bull market now, because the entire deck in CoinGecko is turning green. I traded in my sweater for a sweatshirt. The beginning is there. Exceptionally, Bitcoin dominance will maintain its level of around 50% by the end of February 2024.

Historically, this would be a very early start to the bull market. It usually starts very cautiously in the month of the halving of Bitcoin .

The bulls are scraping their paws on the ground. Looks like they'll be running on it soon. It's party time, mooh!

Historic bull runs after Bitcoin halves

The atmosphere of prediction is in the air. But why really? What is so special about this time?

Bitcoin halving is on the menu. This is an economic event in which miners only get half as many Bitcoins as they are allowed to make a block, because they have lost the cryptographic puzzle first to be solved. This is expected sometime in mid-April 2024. If the price of Bitcoin does not rise, many miners will consider it unprofitable and quit. Until now, Bitcoin bravely became worth more and they could continue.

In the past, the halving event always created what I call the "big bull market." During that period, Bitcoin gains a lot of value and takes the altcoins to a party. Bitcoin then reaches a new high that it partially maintains. Thus Bitcoin spirals upward to higher and higher prices.

You often have smaller bull markets in the intervening periods, where Bitcoin rises hard for a while, along with the altcoins, only to fall back again. This has not happened in recent years. Bitcoin did rise, at a snail's pace, but altcoins hardly rose at all, these moved much sideways. That's why the market felt rather dull, unless of course you only had BTC and bought them for €16K.

In such a large crypto bull market, altcoins can rise tremendously, much more than Bitcoin, if you picked the right one. Usually Bitcoin rises explosively first, and then the altcoins start rising significantly later. Experts, who know how to time this, can use this knowledge to hold Bitcoin first and buy altcoins for their Bitcoin later.

Let's see what the previous major bull markets have produced:

- 2012: Bitcoin experiences its first big run. These are still the early days of crypto, people with PCs were just sitting around Bitcoin mine and received 50 Bitcoins if they solved the puzzle. For 10,000 BTC, you got two pizzas. After the halving, the price of Bitcoin flew up to 500 each. In three years, Bitcoin went from 0 to 500.

- 2016: The second halving. The bull market took a very long time to gain steam. The beginning of 2018 was the "crazy days of crypto." Bitcoin reached a price of €16,500. Bitcoin mining began to turn professional. Alt coins went up dozens of times. The sky was the limit.

- 2020: Third halving. Miners were still getting 6.25 BTC per hit and Bitcoin rose to nearly €60,000. Mining was starting to get so difficult that you had to join mining pools to still have a chance of making a profit. Alt coins did nicely, with the right timing you could still gain up to around 10x.

- 2024: Fourth halving, April 2024. Since the events are in the future, I cannot display them here yet, except to say that you will only get 3.125 BTC per hit as a miner.

Taking things in stride, we get the following picture: Bitcoin skyrocketed in the beginning. After about 8 years, its price chart began to flatten a bit and it was more difficult to make as much profit as before.

Alt coins show the same picture. In the early days of crypto, prices skyrocketed, they exploded in early 2018 and then they follow roughly the same pattern as Bitcoin, which is then the market leader.

Given these developments, then, we may be moderately positive.

There is also some logic behind this. The price of Bitcoin is determined by supply and demand. The money in it has to be coughed up by someone. With a market cap of around 1,000 billion, there is already a lot of money in Bitcoin. So if this pot is to grow, there has to be more interest in Bitcoin, because someone has to pay for the increase in the market cap.

Bitcoin ETF

For a long time, cryptocurrency was something for enthusiasts and fanatics. Ordinary citizens knew what Bitcoin was, but they didn't get much further. Occasionally he heard a little about the market and that a lot of money was being made, but it was still the far from my bed show. The market cap was still so low that it didn't matter much yet. There was still a lot of room for growth.

By 2020, when Bitcoin was only doing a measly x4 in the bull market, it seemed clear that the market was saturated with money from everyone who wanted in. And if no additional money is coming in, the price can't go up either. Compare it to the market for televisions or something. If everyone has a TV I'm sure sales will stagnate or even decline.

Lately, the excitement surrounding the Bitcoin ETF . The SEC from America has given its approval and some very big players are starting to enter the market, such as Grayscale and BlackRock. An ETF means an Exchange Traded Fund. This does not involve investing directly in Bitcoin, but rather, say, betting on the price of Bitcoin.

A big advantage of an ETF is that people who know nothing about blockchain and cryptocurrency and want nothing to do with exchanges and wallets can now invest in Bitcoin, albeit indirectly. This way they only have to put money in without any knowledge.

Some of the big players are also buying Bitcoin for their wallets. As a result, a lot of money is flowing into Bitcoin, giving the price some room to grow again. After all, investment companies and institutional investors like pension funds are bulging with cash. You can already see this happening, as it seems the bull market has started somewhat early, given Bitcoin's rise from around 40K to around 50K in early February 2024.

So there are also signs that it could well be a solid bull market.

Ethereum Dencun upgrade

In the spring of 2024, the Dencun upgrade of Ethereum is expected. The intention of this upgrade is that Ethereum will become much faster and cheaper. This is very good news for traders who have to pay a lot with ETH.

Especially in the DeFi world, this upgrade will be in good spirits. A lot of platforms and networks use ETH for gas. If this can all be done cheaper and faster, this could well cause an explosion of DeFi trading activity, which Ethereum is known for with its ERC-20 token.

In its wake, this upgrade could take both ETH and other cryptocurrencies to much higher prices. Coins like UniSwap and SushiSwap could hitch a ride if the upgrade becomes a success. This could trigger a huge influx of money from traders who until now have found the transaction fees in Ethereum networks too high.

This can all contribute to a bullish scenario.

Market Cycle

In the month of the halving, Bitcoin's price rose every time until now. This year, 2024, Bitcoin is already starting to rise even though the halving is only two months away. Altcoins are also rising with it this time.

Is this a sign of things to come? Is it the harbinger of a long and prosperous bull market? It could well be. The previous bull market began in October 2020 and ended about a year later.

The 2017-2018 bull market began in September 2017 and ended just 4 months later.

So it could very well be that we are going to have a very long bull market. Of course, nothing is certain in crypto, but the omens are there. It would also be nice if the events are stretched a bit so we can enjoy them longer. Let's have a long green deal!

Some caution is always in order, because with a big rise months before the halving, there may well be traders who implement the "buy the rumor, sell the news" principle. In that case, a sell-off may occur after the halving or just before, after which they buy back their coins cheaper for the bull market afterwards.

Larger Bitcoin wallets currently show that we are in the accumulation and HODL phase, where few Bitcoins are still being sold. This allows the price of Bitcoin to rise faster because supply is low.

We are now in the optimistic phase of the market cycle. The belief in another bull run is starting to emerge. It is still very quiet around crypto, as can be seen in Google trends. There are still far fewer searches on it, so the general public is not as concerned with it yet. But once Bitcoin and consorts are in the news more often, the bull market will run at full speed and we may see a new All Time High from Bitcoin before summer.

Fear of missing out

Once the crypto market gives green numbers for a while and all kinds of coins are seriously mooning you will see occasional news items about crypto and more frequent advertisements for related things.

People who see this on TV are starting to wonder if they shouldn't join crypto too, it seems so profitable. They are starting to suffer from FOMO.

With the entry into the market of complete greenbacks, the crypto market will receive a large influx of funds. With these funds, the bubble will be inflated. After all, who can bring new money into the market after the rookies? It is well known that aliens and pets are completely immune to Bitcoin and its mates.

As soon as you hear that your hairdresser, co-worker and sports buddies are going into crypto, it's time to protect your crypto portfolio. It may well be that a lot of money is still coming in, but many more investors are not. The bull market then can't last long and the selling pressure becomes high, while the buyers gradually drop out.

At that point, it's a good idea to get your crypto exit strategy execute. You have a number of options for this, such as selling some or all of your coins. Furthermore, you can set a stop loss to still be able to profit from price increases, but to still have most of your money when the price drops significantly.

Prediction of crypto bull market 2024-2025

As you can see in my crystal ball, all kinds of things are going to happen. Lots of golden lights and fanning out at the edges. Everyone understands that these are excellent omens and that these are going to be golden times!

But, all kidding aside. The bull market started very early. And may continue for a very long time, according to some experts. Some don't expect the crypto bull market to end until 2025.

As always, forecasts are not investment advice.

The price of Bitcoin is difficult to predict, as each bull run is different. One expert believes that €100K will be a reasonable maximum price of Bitcoin, while another is more forward-thinking and believes that €200K is quite achievable. It may be mentioned that the inflow of big money from investment funds and institutional investors, including through an ETF, can significantly affect the price of Bitcoin.

Don't try too much to trade during the bull market. Buy coins and believe in them. Playing a little with change is fine. But the big bucks should actually be in your selected coins sit. Otherwise, you are only paying way too much for your coins when the bull market has already started.

As already mentioned, as soon as people who know nothing about it enter the market, beware. As long as the crypto market is still under the radar on TV and in your own environment, it's steady as she goes. The odds are there, the strategies are determined. Will you take the top prize or will you walk away with a poodle?

These are the times when you can show your worth. Be patient and disciplined. It will serve you immensely.

We give the bouncer of this blog article to none other than Warren Buffett, the best trader of all time, if you ask me:

"Your best investment is yourself. There is nothing that compares to it."