Bitcoin and altcoins - what is their price correlation

- 13 minute read

The price correlation between Bitcoin and altcoins is represented by the Pearson Correlation. This is a number between 1 and -1, with the 1 representing full correlation and -1 representing full inverse correlation. In this article, we'll tell you about the correlation between crypto currencies.

Brief summary:

- The Pearson Correlation indicates the price correlation between Bitcoin and altcoins and is between 1 and -1

- All sorts of events can cause the correlation between Bitcoin and other coins to change

- The more similar a coin is to Bitcoin in terms of price trends or design, the higher the correlation

- By selling in pairs, there will always be correlation between Bitcoin and other coins

- The Pearson coefficient can be useful in constructing your portfolio

- Bitcoin has historically had high market dominance for many important reasons

- The impact of market forces on Bitcoin and altcoins

- Bitcoin dominance cycle is a handy tool to know if altcoin season is imminent

Inhoudsopgave

- What is the Pearson Correlation between Bitcoin and altcoins?

- Why is there correlation between Bitcoin and altcoins?

- What good is the Pearson coefficient?

- Correlation of Bitcoin with other markets

- Why does Bitcoin have such high market dominance?

- Selffulfilling prophecy

- The height of the Pearson correlation between Bitcoin and altcoins

- Bitcoin dominance cycle

- Conclusion Bitcoin and altcoin price correlation

What is the Pearson Correlation between Bitcoin and altcoins?

This is the interdependence of Bitcoin's price with that of altcoins, represented by a price correlation value, the Pearson Correlation. The value of the Pearson Correlation is between 1 and -1, as mentioned above. If the Bitcoin-altcoin correlation between Bitcoin and Ethereum, for example, were 1, that would mean that if Bitcoin rises 5%, Ethereum would also rise by exactly 5%. Of course, this correlation does not occur because of all sorts of reasons. Neither does a negative correlation exist in the crypto world.

If Bitcoin rises and then another coin automatically falls or vice versa, that would be a special godsend though! The only coins that almost always rise when Bitcoin goes down are stablecoins , albeit with minute differences. This is because there is then more demand for stablecoins as traders exchange their coins for stablecoins, causing the price to rise.

Events affecting the Pearson Correlation.

If there is an important update for Ethereum, it can affect the price quite positively. At such a time, the correlation will become different for that moment.

If an approval is found for Bitcoin ETFs , then this will increase the correlation between Bitcoin and altcoins greatly affect it, as an influx of money follows Bitcoin and its market capitalization rises.

Hypes, such as decentralized finance or memecoins, can trigger fear of missing out and loosen the correlation.

Halving events and developments of a road map can greatly affect a currency. Buy the rumor, sell the news. An example of this was when XRP won their lawsuit against the SEC. The price of XRP went up 50% leading up to the lawsuit; after the lawsuit, XRP quickly returned to its old price.

So events in the crypto world have quite an impact on this correlation. Still, high correlations with Bitcoin are quite normal for high ranked coins. Numbers between 0.50 and 0.90 are fairly normal. So these coins have a high probability of moving largely with Bitcoin's price action.

What does the Pearson Correlation say about a coin?

It is well known that altcoins tend to lose around 90% of their value from the peak in the past bull market. There are few exceptions to this rule, such as Ethereum or BNB. Therefore, the correlation between strong coins and Bitcoin is more telling than that of a coin that loses so much that an average is meaningless to name.

The price correlation between Ethereum and Bitcoin is often around 0.70. So most of the time, the price of ETH will roughly track that of BTC. Bitcoin and Ethereum also do not lose 90% of their value in bear markets, which is why this correlation is much more significant.

Suppose you have another coin that also has a correlation of 0.70, but barely tracks Bitcoin's price movements and ends up averaging 0.70 due to its volatility, then of course as a directional indicator this is not very significant.

The lowest correlation between Bitcoin and altcoins is seen with stablecoins. It is at 0.01. This means that there is virtually no correlation between the price of Bitcoin and stablecoins. Logical too, since these coins are supposed to have absolutely no volatility.

Why is there correlation between Bitcoin and altcoins?

There are several reasons for this.

Bitcoin is king

For example, Bitcoin has been the market leader since its creation. You could call the Bitcoin blockchain the barometer for the crypto market. When there was only one coin, Bitcoin had little trouble being that and had 100 percent dominance, but as more cryptos were added, this became more difficult.

For example, there was a brief moment when Ethereum was about to overtake Bitcoin in terms of market dominance. But the rest of the time, Bitcoin has always had a very high market dominance of around 50%. In bull markets this share may drop significantly, because in the altcoin season most altcoins coins rise more than Bitcoin.

Types of altcoins: selling in pairs

You can't just buy Bitcoin for stablecoins. You can also give all kinds of altcoins for it. For example, on almost all exchanges, you have the Bitcoin-Ethereum trading pair. If Bitcoin goes up, Ethereum will usually go up as well. If it doesn't, you can suddenly buy more ETH for your BTC and vice versa.

Virtually all high-ranking coins are part of a Bitcoin pair. As a result, there will always be a fairly high correlation between Bitcoin and other strong coins.

Bitcoin Ethereum correlation

This correlation has gone way up since Ethereum's tremendous growth. Both Bitcoin and Ethereum dropped about 75% after their all-time high since the last bull market. Then they began to rise rapidly again, although Bitcoin did so a lot faster. The two are increasingly running in sync.

So there is a chance that both Ethereum and other strong altcoins like BNB will increasingly parallel the development of Bitcoin's price. By strong altcoins I mean coins that do not completely collapse in the bear market and hold their value pretty well, stablecoins excepted of course.

What good is the Pearson coefficient?

If you have a diverse portfolio want to have coins that have a low correlation with Bitcoin can be useful. In that case, if Bitcoin falls at the beginning of a bear market, not all tokens collapse along with Bitcoin. In a longer-running bear market, you shouldn't really have any cryptocurrency except stablecoins either.

Another way to see it is to buy coins with high correlation precisely when it is a bull market. If you suspect Bitcoin is going to make big jumps upward, it makes sense to buy the highest correlation altcoins. It must be said, however, that the strong altcoins will make less violent price movements.

Correlation of Bitcoin with other markets

For some time, Bitcoin has begun to show increasing correlation with markets outside crypto.

For example, this correlation has been rising with the S&P 500, the NASDAQ and gold for some time. This is somewhat strange, since Bitcoin is supposed to be the counterpart to the conventional financial system, as Satoshi Nakamoto had intended that. In fact, the opposite is true. Economic news from the U.S. in particular often directly affects the price of Bitcoin.

Bitcoin blockchain goes mainstream

Apparently, Bitcoin is becoming mainstream and investors are increasingly confident that it is a store of value, like gold. Especially since the advent of Bitcoin ETFs, which means ordinary investors don't have to learn technical skills like creating an account with a broker, knowing what an address is and how to sell coins at stablecoins.

Since investors now already have about half as much money in Bitcoins as in the largest companies in the world, it is only a matter of time before you could say that for whatever reason more people trust Bitcoin than a company like Microsoft, Google or Apple.

Why does Bitcoin have such high market dominance?

That's because Bitcoin is incredibly popular and well-known. Bitcoin dominance is determined by the market cap of Bitcoin compared to all other cryptocurrencies in terms of market cap combined.

When Bitcoin has a high dominance, there is usually a bear market. Experienced traders know that altcoins then completely collapse and sell them. Two types of coins are then much more popular: Bitcoin (and now Ethereum and BNB) and stablecoins. So many traders sell all their altcoins and swap them for stablecoins or Bitcoin. This partly explains Bitcoin's high market dominance.

In a bull market, Bitcoin can lose considerable market share because experienced traders know that altcoins can rise much more than Bitcoin. So they exchange their Bitcoin and stablecoins for altcoins, because they expect to get more returns from doing so. As a result, Bitcoin dominance drops, or altcoin dominance rises, if you will.

Popularity of Bitcoin

Since the beginning, Bitcoin has been king. Figures like 50% or more market dominance are perfectly normal. There was even a time when Bitcoin had 100% dominance. That was before there were other cryptocurrencies. But why is that really the case? There are more than likely a number of important issues at play.

Everyone knows Bitcoin. It has always been the most popular coin. That's why investors feel safe with Bitcoin, especially the deeper pockets like institutional investors or whales. With the advent of the Bitcoin ETF, this has become even stronger because you can now buy Bitcoin through providers like Grayscale and Blackrock can buy and it is much easier than through a broker or exchange. Bitcoin is digital gold.

Bitcoin ETF

Not everyone is a market expert or has the desire to become one. So many people will be quite willing to take a gamble with Bitcoin, but have little interest in other coins. This has changed somewhat with the vastly increased interest in Ethereum. Once ETFs come out for that, it could mean a lot of money being put into Ethereum by investors who know virtually nothing about cryptocurrency.

Many people also don't like coins with huge volatility. If a coin can lose 50% of its market value or more within a short time or even a day, they don't feel comfortable with that. They would rather invest in a more stable coin. And that's Bitcoin.

Selffulfilling prophecy

Experienced traders know that when Bitcoin rises, that is usually when altcoins rise extra. So it may very well be that as soon as traders see that Bitcoin is rising they quickly buy altcoins to make an extra buck. As a result, altcoins naturally rise more than Bitcoin.

Day traders in particular can take advantage of this feature of the market to grab quick profits, with a trader sometimes owning a token for only minutes. Supply and demand never sleeps.

The influence of traders' stop loss on the price of crypto

Another aspect of the turbulence of altcoins in particular is setting stop losses to protect your investment. Since altcoins tend to fall more than Bitcoin, even a small drop of a few percent from Bitcoin can lead to a selloff event.

Many traders set a stop loss at about 10% loss, after buying an altcoin. This way, they can't lose more than 10% in a trade. If Bitcoin falls 3% and an altcoin falls 10%, they are going to be triggered. Thus, losses can add up quickly, as the selling pressure from traders setting a stop loss creates even more downward pressure on the price.

So a small drop in Bitcoin for altcoins can quickly add up and easily tick up to 15% against a few percent of Bitcoin. If you sometimes wonder why Bitcoin has such high market dominance this certainly plays into it.

Short and long on Bitcoin

Another aspect of the market is futures. When people trade with leverage and go short or long, small changes in the price of a cryptocurrency can quickly have major consequences. Especially long and short positions on Bitcoin can have far-reaching effects on the price of Bitcoin if a sharp drop or rise suddenly follows.

If the price of Bitcoin falls sharply and exceeds 10%, virtually all long positions that had a leverage of ten will be closed or liquidated. Should this happen, this is usually the beginning of a selloff event, in which one selloff triggers the next and you end up in a downward spiral. Bitcoin can easily lose 12-15% on such a day or even more if the drop is so high that other long positions are also liquidated.

Incidentally, the sharp decline of altcoins also has an effect on the price of Bitcoin, which can then be pulled into the downward spiral, due to its pair selling.

Altcoin massacres

For altcoins, such days can cause true carnage. If Bitcoin goes down by a few percent, this can already cause violent price reactions for altcoins. How about if Bitcoin drops by 15-20% in one day? Altcoins could then fall around 30-50%! Anyone who has been in the cryptocurrency world long enough knows these days all too well. During the last bull market in May, this was the most intense event, with altcoins falling 50% in value within a few days! That did scare many traders.

That reminds me of that saying from the stock market, "Sell in may and go away." If only I had done that!

Altcoin explosions

Of course, the opposite is also true. When Bitcoin rises, altcoins usually rise more strongly, especially in a bull market. Bitcoin dominance should be kept in mind here. Altcoin season begins when Bitcoin dominance declines sharply and altcoins thus become more valuable relative to Bitcoin. This usually happens when a bull market begins to gain steam.

If there are many short positions because traders expect the price of Bitcoin to go down there can be considerable buying pressure when Bitcoin rises. If you go short you are not only betting on a decline, but you also have to buy Bitcoin when you close the position or when you are liquidated because you no longer have enough collateral. Once many of these short traders have to buy Bitcoin, the price of Bitcoin can rise significantly within a short period of time and a so-called short squeeze and snowball effect on the rise of Bitcoin can occur. Good news for Bitcoin owners and usually even better news for altcoin owners. There is even a site that keeps an index of when altcoin season begins.

The height of the Pearson correlation between Bitcoin and altcoins

The Pearson correlation coefficient between Bitcoin and altcoins changes as a coin becomes more or less popular. For example, Ethereum and BNB have started to behave a lot more like Bitcoin in terms of price and so the coefficient becomes a lot higher. Think of a number between 0.70 and 0.85.

One of the strongest relationships is between Bitcoin and Litecoin. This is because Litecoin is a fork of Bitcoin and is very similar to it. Litecoin has a coefficient close to 0.90.

The less a coin follows Bitcoin's movements, the lower this number. With these numbers, you can better predict the extent to which an altcoin follows Bitcoin as its price changes.

Bitcoin dominance cycle

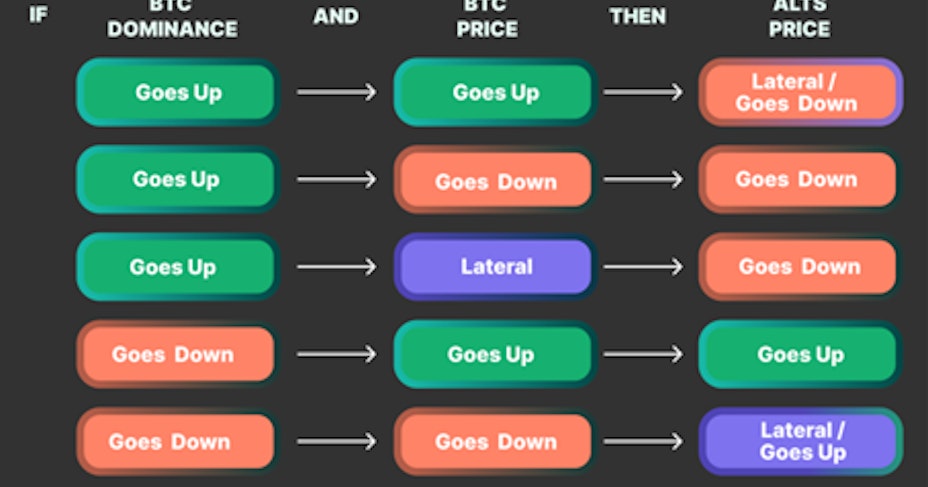

A handy visual tool to know which direction altcoins are taking in response to Bitcoin dominance and Bitcoin price can be seen below:

Source: https://www.coingecko.com/

Here you can see at a glance how those two variables affect altcoins. Altcoin season starts on line 4: Bitcoin dominance decreases and the price of Bitcoin increases. That means the value of altcoins is increasing rapidly.

That is when you might decide to invest in altcoins in particular.

Conclusion Bitcoin and altcoin price correlation

Bitcoin and altcoins always have a correlation. If the price of Bitcoin changes, the prices of other coins will also move. Knowing the historical coefficient can give you a handle when buying cryptocurrencies.

Then if you still know the Bitcoin Dominance Cycle you at least have a guideline of what stage of the market you are in and which coins are best to buy or not.

This is a good addition when using technical analysis . This allows you to get an increasingly broad view of price trends in the crypto world, and it is never a futile effort.