What is the market cycle crypto

- 15 minute read

The crypto market cycle is a recurring wave motion, in which the prices of all crypto rise and fall according to similar patterns, but at different heights.

A market is a place where supply and demand come together. A cycle is a recurring sequence of similar events.

The analogy of the market cycle of cryptocurrency can be compared to the seasons. In spring, cryptocurrencies start to rise, in summer the highs are to the top, in autumn the prices start to fall and in winter they drop to questionable heights until they find the bottom.

- The market cycle in crypto can be compared to that of stocks, with 4 seasons in which prices rise and fall in the bull and bear market

- To use the cycle effectively, you must buy around the bottom and sell around the top

- New investors often lose money because they buy coins that have already gone up a lot

- The four seasons in crypto can be described as the accumulation, growth, distribution and cooling phase.

- Bitcoin halving and Bitcoin mining have major impact on market cycle

- Because there is already so much money in Bitcoin, it is becoming increasingly difficult to quote higher prices and the rise curve is flattening, as more and more new money is needed for an ever-smaller rise in the price of Bitcoin, the market leader

- With the advent of the ETF for Bitcoin, big investors like Blackrock and pension funds are now entering the market as well

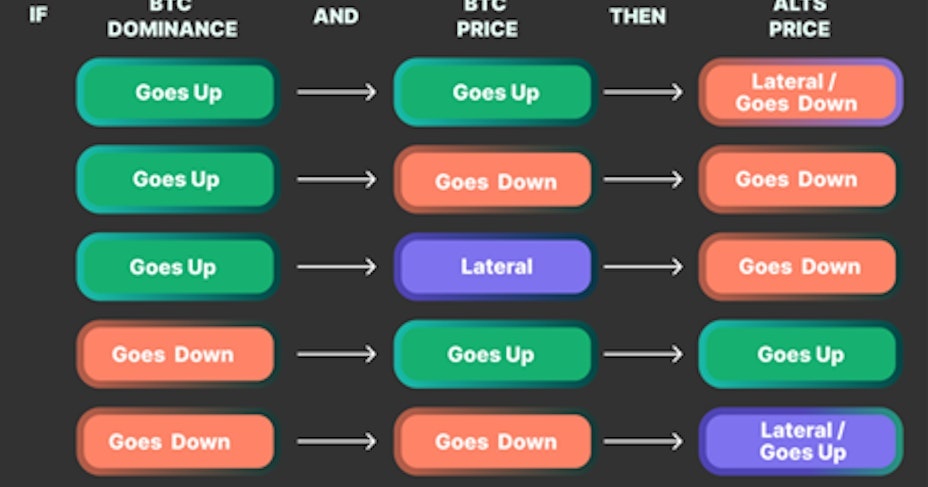

- If Bitcoin dominance falls, but Bitcoin prices still move higher, the altcoin season has arrived, in which altcoins rise harder than Bitcoin

- In every bull market, you see meme coins and hype coins outperform, but there are also greater risks involved

- The perfect strategy depends more on your risk tolerance than on the time of purchase, although that plays a strong role

- The market cycle is influenced both by factors within the crypto market and by developments in the outside world, such as interest rates, advertising or a recession

- Predictions of upcoming market cycles can be made by watching market sentiment or by technical and fundamental analysis

- Working with a global plan to buy and sell coins can positively affect your results

Table of Contents

- How does the crypto market cycle work?

- The four phases of Bitcoin's market cycle

- What is the Bitcoin halving?

- Leveraging the market cycle

- What factors influence the market cycle?

- Prediction of cryptocurrency cycles

- Why is market cap important in the market cycle?

- Determining the end of a market cycle

How does the crypto market cycle work?

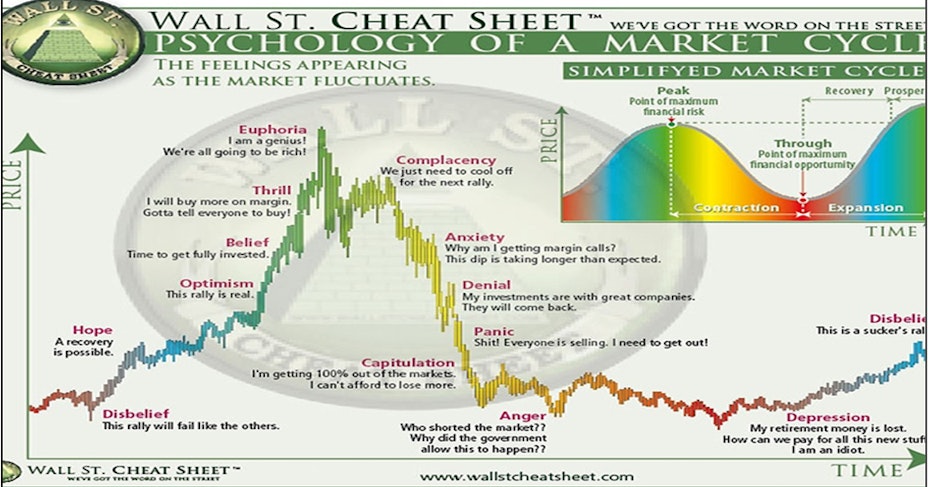

The market cycle in the world of cryptocurrency actually works pretty much the same as in the stock world and traditional financial markets. If you look closely at the picture below you can see how stocks often evolve over time, but Bitcoin shows a similar trend.

The reason we look at Bitcoin in particular is that this coin is the market leader and all other coins are being pulled along in its wake, up or down.

The development of Bitcoin's exchange rate has a strong correlation with the Bitcoin halving , about which more later. First, we will examine the complete cycle so that we know how this market cycle actually develops.

Wall Street Cheat Sheet

This is a very familiar picture in both the stock and crypto markets. A cursory glance tells us that there are two very important points in the chart. These are the bottom and the top. You naturally want to buy at the bottom and sell at the top.

The bottom is usually identified by a sideways movement of Bitcoin that lasts for days to weeks. Bitcoin has fallen in price to the point where everyone who wanted to sell Bitcoin has then done so. Sellers have run out and prices are no longer falling. Cryptocurrency is completely out of the spotlight and a new cycle is about to begin.

From bear to bull market

If there are almost only buyers left, the price must be rising. The end of winter is approaching for Bitcoin, making that the best time to buy in for smart investors. The bottom has been reached and anger and depression move through disbelief and hope to cautious optimism. Big investors make their move here.

The peak can usually be recognized by very steep climbs in the price of Bitcoin. Something else you recognize it by is the behavior of traders and the media. When everyone is talking about cryptocurrency and the prices go through the roof you will see that even people at the barbershop and in the pub are talking about it. People who never had much use for cryptocurrency have suddenly invested. One advertisement after another from exchanges and other providers suddenly appear on television or other media.

Why new crypto investors often lose

Once the buyers run out, the price does have to go down. This is why newbies often lose a lot of money, because they only enter the market when prices are already very high, have no realistic prediction and do not use financial instruments. Once the total madness has erupted and many believe that the trees grow to the sky, it is time to watch out. The top is near and profits must be secured. The thrill and euphoria turn into complacency and anxiety.

The four phases of Bitcoin's market cycle

Four phases can be distinguished in Bitcoin's market cycle. You can also see these in that picture. Everyone calls these differently, but we will call them accumulation, growth, distribution and cooling.

- Accumulation. This phase is characterized by low trading volumes and little interest from the outside world. In the picture, we are then at anger and depression. Bitcoin's price flattens out and finds a bottom. The best and biggest investors start here gradually to buy Bitcoin , causing the share price to reluctantly begin to rise. Many ordinary investors dare not buy here yet, fearing that the prices will fall even further, after the " debacle" of previous bull market . Hardly anyone is selling Bitcoin here anymore, all the more reason that the price can only go one way. Market sentiment is very negative, except among the smartest investors who actually see this as a godsend.

- Growth. Hope and optimism are beginning to grow, as are volumes. Could Bitcoin's price really persevere? Is this a good time to buy? Many traders are still hesitant here, watching the price rise little by little. It may be going slowly, but it is definitely going up. During this period of growth, it is all so slow that traders don't find out that the price of Bitcoin has risen solidly until they look back months into Bitcoin's chart. This period is the prelude to the bull market. At some point the growth is so obvious that smaller investors also enter the market and the enthusiasm is back. Once they enter the market, there is so much buying pressure that prices start to rise rapidly.

- Distribution. The market is in its euphoric state and everyone thinks they can get rich quick. Prices are rising so fast that lots of new entrants are appearing on the market and volumes are going through the roof. However, these are the latest entrants to the market. Remember that it is a zero-sum game and one person's gains must mean another's losses. The money has to come from somewhere. This is the time when the big investors and investment funds who bought in the accumulation phase and had not yet exited the market in the growth phase will now do so. They are distributing their expensive coins to new entrants and taking their profits. Since there are no more new buyers to tap into, there will be high selling pressure. Euphoria gives way to fear and panic. Rates suddenly start falling hard and new entrants don't know what to do. Some will sell their coins here at a slight loss, while others hope that things will still work out. Later, they often sell their coins in panic, creating even more selling pressure. The bear market has begun.

- Cooling. The prices of Bitcoin and other coins continue to plummet during cryptocurrency's cold autumn days. New investors are not to be found. Altcoins can lose as much as 95% of their value from the highest price in the past bull market, Bitcoin can fall as much as 80% in value. This descent flattens out over time as the path to the next bottom is sought. Those who sell their coins at this stage usually have huge losses. Especially newbies give up then, believing it is all a conspiracy or that they can't do anything about it. However, this is not the case. It is simply a market cycle. Once you know it you can just work with it, without emotion.

What is the Bitcoin halving?

Bitcoin halving means that after 210,000 new blocks are mined on the Bitcoin blockchain miners only get half as many new Bitcoins when they are allowed to create a new block, which occurs about every four years. This is an economic event for miners, because they need to earn enough from the mine to continue their activities.

What is Bitcoin mining?

If you start mining Bitcoin you will have to deal with Proof of Work . Anyone can try to mine Bitcoin, but only the winner gets to make a block and create new coins. The winner is someone who has a very difficult cryptographic puzzle know how to solve it first. For this you need very expensive equipment these days, in addition to consuming a huge amount of energy.

Still, we will have to take this side trip into Bitcoin mining for a moment so we know how halving and other factors affect Bitcoin's price.

Mining pools

Miners therefore work together in mining pools, because as standalones they have no chance of getting that much computing power together. These so-called hashing power is so expensive that only partnerships of wealthy investors have enough money to participate. Usually mining equipment is in countries where energy is not yet so expensive to keep costs down.

So whoever solves the puzzle gets to make a new Bitcoin block. The rewards for this are the transaction fees of all transactions of the past ten minutes (a new Bitcoin block is created approximately every ten minutes), plus a fixed amount of Bitcoin, which thus halves approximately every four years. The less Bitcoin you receive as a miner, the less you earn. When miners no longer earn enough, they can decide to stop mining.

The consequences of halving Bitcoin

Satoshi Nakamoto , the mysterious creator of Bitcoin, designed this first cryptocurrency so that it has the chance to become worth more and more. There is a maximum number of 21 million, as opposed to fiat money , which is constantly reprinted and becomes worth less and less. He was therefore a great opponent of that system.

Bitcoin scarcity

As Bitcoin remains scarce and interest in the coin increases, we see Bitcoin spiraling higher and higher over time. We see higher highs and higher lows appearing, just as Nakamoto envisioned. In this way, miners can also stay in the market because their smaller amount of Bitcoin they receive are offset by higher prices per Bitcoin.

Bitcoin rates after halving

In 2012, the amount of Bitcoin you got if you solved the puzzle halved from 50 to 25, in 2016 to 12.5, in 2020 to 6.25 and in 2024 to 3.125 per mined Bitcoin block.

The higher compensation for miners is reflected in Bitcoin's price after each halving so far. In 2012, after the first halving, Bitcoin's price shot from 20 to 500 euros. After the 2016 halving, Bitcoin tapped 16,500 euros in early 2018. After the 2020 halving, Bitcoin's price soared to 60,000 euros. You can see that the rate is going up less and less. This is for a simple reason.

Bitcoin and market cap

In the beginning, the market cap of Bitcoin was not that high yet. There was so little money in the pot that doubling investments did not cost that much money at all. By 2024, more than 1,000 billion has already been invested in Bitcoin, doubling it would cost huge investments, which the world would just have to cough up. That's why you get the flattening of the curve. Bitcoin's price will probably continue to rise during any bull market, but the times of x10 or more are over. Therefore, many traders are looking for promising crypto with a lower market cap that can still perform this way.

Macro economic development

In the spring of 2024, something special did happen. Bitcoin soared through its All Time High around even before the halving was a fact. This was due to the approval of the Bitcoin ETF by the SEC, causing a lot of money to be invested in Bitcoin through large investment funds. Then another big drop followed.

At the time of writing, the market is anxiously waiting to see if another major bull market after the halving occurs in late 2024. Developments in the outside world can also affect the price of cryptocurrency, such as the U.S. election, economic uncertainty, technological developments or a recession and the like.

Leveraging the market cycle

If you looked closely at that Cheat Sheet image you might come to the conclusion that it's not all that difficult after all. You buy Bitcoin at the bottom and sell again at the top. You don't care about anything else.

Making a profit with Bitcoin

Indeed, there are investors who more or less do this. Large funds in particular have little desire to run large risks with altcoins. They therefore specialize in Bitcoin purchases and try not to do too much. If you have a return of hundreds of percent every 4 years, that's more than enough, they reason. There is some merit in that, of course.

Let's write a scenario for after this bull market in 2026. You buy Bitcoin for 20 to 25 thousand euros and sell when it is around 100,000 euros in 2028-2029. Then you wait until the next 4-year market cycle arrives. That sounds simple enough, right?

There are a number of problems with this approach. For example, buying at the bottom is very difficult. Do you dare to? Selling at the top is also very difficult. It may well rise even more, do you sell it? Real professionals say yes to these questions. Do you?

Greed and low initial capital

Another problem is greed. Many people do not have as much money as the big funds. Suppose you start investing with 2000 euros, then x4 every 4 years is actually still very little money. People immediately want x10 or more. This is very understandable, but not smart. If you are going to invest in cryptocurrency you really need to build it from the ground up, have a foundation of understanding and let your money grow organically.

The next consideration is one that many investors also make: if I invest in Bitcoin, do I have a chance at x10? Well, not these days. Do I have a chance of that with other cryptocurrencies? Yes, but you have to happen to pick the right ones. And you have to sell them when they finally hit x10. Still, many investors choose to invest in altcoins and hope they picked the right coins and will do the right thing.

The impact of Bitcoin dominance

Source: CoinGecko.

In the market cycle, you will also be introduced to the Bitcoin dominance . In bear markets, you see this dominance steadily rising. There has been a tipping point in every bull market so far, where Bitcoin dominance began to decline. They call this altcoin season. During those times, Bitcoin rises, but the other coins rise much more. Huge profits can be grabbed during those times, if you "happen" to own the right altcoins.

Altcoin season

There is even a website that tracks which coins are doing best and whether it is altcoin season:

https://www.blockchaincenter.net/en/altcoin-season-index/

You can see the situation of altcoin season on line 4 of the image. Bitcoin keeps rising, but its market share is declining. In a relatively short period of time, then, certain coins can suddenly go through the roof. But which ones are they?

Bull market and meme coins

We see that in bull markets, meme coins in particular always do well. The reason is that new investors are entering the market who know little about crypto and blockchain technology. Those are really not impressed by the next layer2 protocol, which should support the Ethereum network or a DeFi protocol with unique aspects. They prefer to buy meme coins .

What also counts is that they can buy a lot of coins, because meme coins are often made up in large quantities. If you have 5 million BONK, it still feels different when you just joined than if you have 0.001 BTC. Moreover, meme coins often have an attractive picture and a nice community to fool around with. Much more fun than those serious pockets of Ethereum or the like.

With meme coins you can make a lot of money, but also lose a lot. It is pure gambling. Tomorrow the popularity of such a coin may collapse and the day after tomorrow it may be worth nothing, whether or not after a rug pull . It is therefore prudent to have one good crypto portfolio on it and limit your risks. Also, do not follow influencers who often want to foist meme coins on you for the sole purpose of benefiting themselves.

Temporary hypes

In altcoin season you also often see hype coins emerge. These are cryptocurrencies that suddenly begin to skyrocket out of nowhere, scoring one All Time High after another. These coins can also quickly begin to decline in popularity and quickly become worth less, but it is a lot slower than meme coins. Sometimes the popularity persists and you have a real winner on your hands, like Chiliz in 2021, which went from a price of around cents to a whopping 60 cents! However, these kinds of excesses are rare, so don't count on them too enthusiastically.

Another coin that exploded was Terra Luna. This rose from less than one euro to more than 100 euros. Its demise was rather sad. In a smart contract that was supposed to hold this coin together contained a weakness that was exploited, causing the whole system to collapse and rendering the coin worthless.

The Terra ecosystem used what is known as a dual token system within a smart contract in which TerraUSD (UST) was stabilised by burning and minting LUNA. When excessive selling caused the price of the stablecoin to fall from $1, but it could still be bought and sold for $1 in the form of LUNA, there was an arbitrage opportunity, which led to the hyperinflation of both tokens and ultimately to their collapse. This is where investors lost a lot of money.

The perfect strategy

So if you want to play perfectly you buy Bitcoin at the bottom, sell it when altcoin season starts and buy the best coins that grow the most, then sell before the bear market starts. However, that sounds much simpler than it really is. If you even come close to these few rules you will be a very successful crypto trader. However, this rarely happens. Most traders lose money with cryptocurrency. Investing in crypto is extremely difficult, although it looks like it is quite doable.

So you have the option to focus purely on Bitcoin and take very little risk or wait for altcoin season and try to pick out the strongest growers. If you prefer the latter, it is a good idea to take profits from time to time or regularly adjust your stop loss so that you are not suddenly surprised by the start of the bear market and all your profits start to evaporate. A diversified approach can work very well.

You don't need to maximize profits, gaining profits is good enough. Temper your greed through contentment! Maybe you could have earned more, but you could also have lost by acting thoughtlessly. Next time you will probably do just a little better. Positive experience is crucial when investing in cryptocurrency.

The most important consideration

Never forget what we talked about: altcoins can lose up to 95% of their value in a bear market. You don't want to sit and watch that! Bitcoin can drop as much as 80% in price. Make sure you sell your coins before the bear market is in full swing, or you can kiss your money goodbye!

"Be fearful when others are greedy and greedy when others are fearful."

What factors influence the market cycle?

- Selffulfilling prophecy. Because the four-year cycle still came back, the same will be true in the future. Once the Bitcoin halving has occurred the fever begins to rise and investors sit anxiously waiting for it to begin again. Once the price of Bitcoin has risen solidly many people get in and it actually starts. By the way, past results are not a blueprint for the future.

- The outside world. Economic conditions from the outside world or regulation can firmly influence the crypto market. For example, a recession or high interest rates can get in the way of price increases. Regulations can also affect the market positively (ETF) or negatively ( MiCA ) affect.

- Developments within the crypto market. The collapse of FTX or a country's sale of Bitcoin could firmly depress prices by spreading FUD (Fear, Uncertainty, Doubt), but the advent of multiple forms of ETF could make the crypto market mood more positive.

- Influencers or celebrities. Big names inside and outside the crypto world can influence sentiment quite a bit. If Trump is very pro Bitcoin, his election can be a solid boost. If Musk does another tweet about Dogecoin this can make Dogecoin bullish in the short term.

- Media. If there is a lot of advertising on television and social media for cryptocurrency, this can attract new investors and further boost the prices.

Prediction of cryptocurrency cycles

There are two main variants of forecasting cycles, short-term and longer-term.

Market sentiment

In the short term, aspects such as FUD and FOMO . FUD can usher in a bear market by all that negative chatter on social media, newspapers, the news and everywhere you go. FOMO can bring about the opposite by shouting hosanna about the crypto market everywhere.

A tool for this is the Fear and Greed Index . On this site, you get a number between 0 and 100, where 0 represents extreme fear and 100 represents extreme greed. So you can see at a glance what the market sentiment is like. Market psychology is a typical herd phenomenon, where the mood can change very quickly. Often you see that at very high figures of this index there is a correction follows.

Technical analysis

In the short term, you can also use technical indicators to forecast the market, setting these indicators to say something about the last few days and the days ahead.

If we look at the longer term, we can also use indicators, but we will have to use much longer time periods, such as, for example, a Moving Average of at least 50 days and 200-day averages, so that we can see major changes in the market and the turning point coming from miles away, such as a golden cross or a death cross, which often herald the bull market and the bear market.

Fundamental analysis

A fundamental analysis can tell us which cryptocurrencies are so well put together that they will do well in the coming bull market. For example, the fastest blockchain with the lowest transaction costs and a growing ecosystem could be high profile once the bull market starts and transaction costs start to play a big role because there will be a lot more trading.

If you look at the Bitcoin chart in CoinGecko and look at the max chart you can easily distinguish the cycles and make a plan in advance to profit from them. After all, that is the purpose of predicting cycles, we don't need to join "The Weather," we want to make profits. Knowing Bitcoin's cycles is a strong handle for this.

Why is market cap important in the market cycle?

The market cap shows how much money has been put into a cryptocurrency. The lower it is, the easier it can go up in percentage terms. In Bitcoin's early years, there was so little in the pot that doubling up was fairly easy. This allowed prices to go completely through the roof in 2018. Going from 1,000 euros to 16,000 euros "only" cost around 300 billion euros.

Flattening chart rise Bitcoin

Today, there are more than 1,000 billion euros in Bitcoin, so doubling it costs so much money that it won't happen overnight. If you know that all the money in the world adds up to about 1000 times 1000 billion euros (this changes every year), you know that already 0.1% of all the money in the world is in Bitcoin. That's already a lot for a cryptocurrency. So the path from Bitcoin to 1 million euros each would go to say 20,000 billion euros invested in Bitcoin in total, about 2% of all the money in the world. I certainly don't rule out the possibility of this ever happening, but it will be very gradual. So the crazy days of early 2018 are well and truly over.

When do you buy and sell your crypto coins?

When you look at the market cycle it seems so easy. You buy Bitcoin in the bear market and sells these at the beginning of the bull market. Then you buy the right altcoins in altcoin season and sell them for a big profit. Tight plan! Let's do it!

What you see a lot of, however, is that traders are afraid to buy Bitcoin around the bottom and are too euphoric at the top to sell it. Emotions get in traders' way.

Dollar Cost Averaging helps you avoid emotions, you buy in the same amount every month, so you will pay about an average price. Doesn't take away the fact that you still have to sell around the top then to make a profit.

The fog while trading

So you will have to have a plan, selling crypto coins according to a predetermined strategy. If you are in the middle of the bull market, your vision is often not so clear. You can then start making big mistakes due to emotional decisions. Indicators can help you make short-term and long-term decisions easier.

Besides the indicator, you can also make rational trade-offs. If you know that Bitcoin can lose 80% of its value and altcoins up to 95%, do you still want to take this risk or is this a good time to exit the market? To get an answer to this question, you can at least consult a few indicators that show longer-term developments.

Determining the end of a market cycle

If a particular cycle is coming to an end, such as a bull or bear market, you will have to take action at some point. At the end of a bear market, it's not a bad idea to buy Bitcoin. At the end of a bull market, it is not a bad idea to sell all of it, or at least more often some of it, if you have doubts that it is over.

Use your experience and signals

So how do you know if the end is in sight or has already happened? For that you use indicators, common sense and gut feeling. Experience counts very heavily in this young world and will guide you to a honed crypto brain. Listen to what the longer-term signals are telling you and zoom out, because mistakes are just too costly. Better to sell your crypto a week too early than a week too late.

The bear market is a hiking trail, the bull market a highway. So treat them that way.

"If you want to double your money, you will have to halve the risks."