Ethereum Price Prediction 2025 - 2030

- 8 minute read

After the Bitcoin ETF got the green light early in 2024, it was followed by the Ethereum Exchange-Traded Fund by the end of the year. Ethereum's still lagging a bit behind other big coins like Solana and, of course, Bitcoin, which has been hitting several all-time highs over the past few months. In this article, we'll dive into what experts are predicting for Ethereum in 2025.

The price development of Ethereum depends mainly on:

✔️ How Ethereum continues to develop technically;

✔️ Whether there is a bull market or bear market;

✔️ How the global economy develops as a whole.

Table of Contents

- Ethereum forecast 2025 - 2030

- Ethereum ETF

- What is Ethereum?

- Who is Vitalik Buterin?

- Tokens on Ethereum

- The Merge

- Issuing and burning of ETH

- Activity on the Ethereum network

- Ethereum Roadmap

- Shanghai Update

- What is sharding?

- The Surge, Scourge, Verge, Purge & Splurge

- Ethereum's price history

- Fidelity

- Could Ethereum reach $50,000?

- Realistic predictions

- Conclusion

- Other price predictions

The Ethereum prediction in 2025 and 2026

On June 23rd, the Securities and Exchange Commission approved 8 Ethereum ETFs. It's expected that, just like with Bitcoin, there will be a big influx of institutional investors in America. The approval of these ETFs could be a huge step for the future of Ethereum.

Plus, the Bitcoin Halving went down in April 2024, which is often seen as the trigger for a new bull run, something that could benefit Ethereum and the whole market. So the outlook for 2024 looks good for the Ethereum price.

Earlier we saw that the Merge caused a change in Ethereum's issuance policy. Whereas standard coins were previously added to the supply, with the implementation of the Ethereum Improvement Proposal 1559, this is no longer the case with current activity. The issuance policy is currently only just inflationary with annual inflation just above 0 (0.013%/year) since the merge. Since we are currently in a bear market and thus activity on the network is lower than in a bull market, issuance policy will logically move to deflationary with increased activity. This could have a major impact on the price over time. Because of this, some are bullish on Ethereum and foresee "the flippening.

On June 18, the U.S. Securities and Exchange Commission (SEC) announced that it has ended its investigation into Ethereum (ETH). This means that no charges will be filed against the developers or parties involved. Consensys, a major developer within the Ethereum community, announced this news, describing it as a major victory for the industry. The investigation focused on whether Ethereum should be classified as a security. However, the SEC retains the ability to take further action in the future.

The Ethereum ETF Pressures the Price

In recent months, Ethereum exchange-traded funds (ETFs) have experienced significant capital outflows, which has restrained Ethereum's recent price rise. Since the launch of spot Ethereum ETFs in the United States on July 23, 2024, a trend of net outflows has been observed. For example, between August 15 and August 21, these ETFs recorded outflows of $92.2 million, mainly influenced by the Grayscale Ethereum Trust (ETHE), which reported more than $2.5 billion in outflows in recent months.

On October 1, 2024, the Fidelity Ethereum Fund (FETH) recorded a single-day record outflow of $25 million, the largest daily outflow since its launch. On the same day, U.S. spot Ether ETFs saw a total outflow of $48.6 million across nine issuers, with both Fidelity and Grayscale reporting significant losses.

This ongoing outflow of capital from Ethereum ETFs has had a negative effect on Ethereum's price. Although Ethereum’s price has shown some volatility in recent months, the significant outflows from ETFs have limited upward momentum. Investors remain cautious, partly due to the continued outflows from major funds such as those of Grayscale and Fidelity, which affect Ethereum’s price dynamics.

The U.S. Elections

The recent re-election of Donald Trump as President of the United States has led to optimism in the crypto market. Trump has voiced support for a more favorable regulatory environment for cryptocurrencies. After his victory, Bitcoin reached an all-time high of $124.457 and other cryptocurrencies, including Ethereum, also saw significant price increases. Investors are anticipating potential laws and proposals that could further drive crypto adoption and growth.

Ethereum forecast 2025 - 2030

Making forecasts remains very risky in the cryptocurrency industry. Therefore, making an Ethereum price forecast is very difficult. The Ethereum price over the next few years depends heavily on a number of factors:

- What developments Ethereum has undergone and what are to come;

- How does the crypto market as a whole move, is there a bull market or bear market;

- How is the global economy moving as a whole, economic growth or contraction.

Each of these factors can have a very emphatic impact on the Ethereum price. Despite that, there are agencies that do an Ethereum forecast for the next few years based on their own algorithms. Below is Digitalcoinprice's Ethereum forecast 2025 - 2030:

| Year | Minimum price | Average price | Maximum price |

|---|---|---|---|

| 2025 | € 3.314,31 | € 7.437,29 | € 8.148,38 |

| 2026 | € 8.032,11 | € 9.305,49 | € 9.640,85 |

| 2027 | € 11.009,94 | € 12.931,24 | € 13.630,74 |

| 2028 | € 14.393,05 | € 15.872,06 | € 17.174,23 |

| 2029 | € 14.393,05 | € 15.872,06 | € 17.174,23 |

| 2030 | € 17.751,47 | € 20.015,23 | € 20.392,08 |

Ethereum Price Prediction 2025

Ethereum’s outlook for 2025 points to renewed upside momentum. The minimum forecast of €3,314.31 represents a move of –10.9% from today’s price of €3,722.20. The average price projection of €7,437.29 implies a gain of +99.8% , while the maximum forecast of €8,148.38 signals a potential rise of +118.9% . With the rollout of Layer-2 solutions, greater institutional exposure via spot ETFs, and Ethereum’s continued role in DeFi, 2025 could mark the beginning of a new growth phase.

Ethereum Price Prediction 2026

The bullish trajectory looks set to continue into 2026. A minimum price of €8,032.11 reflects a rise of +115.8% , while the average forecast of €9,305.49 points to +150.0% growth. The maximum projection of €9,640.85 suggests an impressive +159.0% surge. By then, Ethereum’s role in tokenized assets, enterprise blockchain adoption, and identity solutions could further strengthen its market dominance.

Ethereum Price Prediction 2027

Ethereum is expected to maintain strong momentum in 2027. The minimum forecast of €11,009.94 implies +195.8% growth, while the average price of €12,931.24 represents a gain of +247.4% . The maximum target of €13,630.74 translates to an increase of +266.2% . By this stage, Ethereum could be firmly established as a core global settlement layer powering advanced financial infrastructure and large-scale tokenization.

Ethereum Price Prediction 2028

Expectations for 2028 remain highly positive. The minimum projection of €14,393.05 suggests a +286.7% increase, while the average forecast of €15,872.06 points to +326.4% growth. The maximum outlook of €17,174.23 signals a +361.4% surge. Broader adoption of Web3 gaming, AI-integrated contracts, and government-backed blockchain projects could be key drivers of this growth.

Ethereum Price Prediction 2029

Interestingly, the projections for 2029 mirror those of 2028: a minimum of €14,393.05 (+286.7%) , an average of €15,872.06 (+326.4%) and a maximum of €17,174.23 (+361.4%) . This could indicate a period of consolidation, where Ethereum’s valuation stabilizes while reinforcing its position as a mature pillar of blockchain infrastructure.

Ethereum Price Prediction 2030

By 2030, Ethereum’s long-term potential looks extraordinary. The minimum projection of €17,751.47 implies a surge of +376.9% , the average forecast of €20,015.23 signals +437.7% growth, and the maximum target of €20,392.08 represents an increase of +447.9% . If these projections materialize, Ethereum could evolve into the backbone of a fully tokenized global economy and digital financial system.

Date of update: August 29, 2025

Ethereum ETF

The Ethereum Spot ETFs have been officially approved for trading in the US, finally! Crypto folks have been waiting for this for weeks, ever since the SEC gave the first batch of approvals back in May. Now, with the S-1 filings also approved, trading can start today. Eight ETFs from Grayscale, Bitwise, Blackrock, VanEck, ARK 21Shares, Invesco Galaxy, Fidelity, and Franklin Templeton are all good to go. Trading is only allowed in the US, though. In Europe, these index funds aren’t permitted. These ETFs let investors benefit from Ethereum's price movements without having to buy the cryptocurrency directly. This is especially interesting for institutional investors who can't invest directly in crypto. People are expecting a similar impact as with Bitcoin. After the Bitcoin ETF approvals earlier this year, the BTC price hit a new record high.

What is Ethereum?

Ethereum is a decentralized global software platform that allows developers to create secure digital technology. In 2013, Vitalik Buterin (founder of Ethereum) published his white paper describing Ethereum as an open-source and public blockchain-based distributed computing platform that can execute smart-contracts. Ethereum's proprietary cryptocurrency, Ether (ETH), is used to pay for work that the blockchain supports, but participants can also use it to pay for tangible goods and services if accepted. Ethereum is like a marketplace of financial services, games, social networks and other apps that value your privacy and cannot censor you.

The fuel of the network is called Ether and runs all the smart contracts that dictate every move. Ethereum is designed to be scalable, programmable, secure and decentralized. It is the blockchain of choice for developers and enterprises that are basing technology on it to change the way many industries work and our daily lives.

Who is Vitalik Buterin?

Vitalik Buterin is a Russian-Canadian writer and programmer who has been involved in the Bitcoin community since 2011. He co-founded Bitcoin magazine and is best known as the person behind Ethereum. Vitalik likes Bitcoin but considers it "limited functionality". He illustrates the difference between Bitcoin and Ethereum by comparing a smartphone to a calculator.

"Think about the difference between something like a pocket calculator and a smartphone, where a pocket calculator does one thing and it does one thing well, but people actually want to do all these other things. And, if you have a smartphone then on the smartphone you have a pocket calculator as an app. You have music playback as an app. You have a web browser as an app and pretty much everything else."

Tokens on Ethereum

On the Ethereum blockchain, in addition to Ether, several other tokens live. These tokens have all kinds of different formats such as ERC-20, ERC721, ERC-777, ERC-1155 or the ERC-4626. We will now briefly explain the most important and widely used token standards.

The ERC-20 token standard used for most tokens on the Ethereum network. Tokens like USDT and USDC are ERC-20 tokens. However, almost all ICOs launched on the Ethereum network were also ERC-20 tokens. The ERC-20 token standard offers various functionalities such as sending tokens from one account to another or the ability to see the total supply of available tokens.

ERC-721 is the standard format used for NFTs on the protocol: the 'non funigble tokens' around which there has been a lot of hype in recent years and considerable amounts have been traded. NFTs can be used for collectibles, access keys, lottery tickets, etc. In addition, an NFT can also have visual properties, as we saw with the Bored Ape Yacht Club or CryptoPunks. These can be traded on OpenSea or other platforms.

Other (less popular) token standards are the ERC-777, ERC-1155 and the ERC-4626. These can be used for additional functionalities such as mixer contracts, efficient trades and tokenized Vaults.

The Merge

In 2022, 'The Merge' took place on the Ethereum network. This took the network from consensus mechanism proof-of-work (PoW) to proof-of-stake (PoS). This was a major milestone in crypto history that took 6 years to build. With this merge, Ethereum moved from the Ethereum Mainnet to the Beacon Chain. So in the process, the history of the proof-of-work chain was converted to the proof-of-stake chain.

Many users thought the cost of transactions would become lower after the transition from PoW to PoS. Although this is a long-term goal for the Ethereum network, it was not achieved with the merge. Layer-2 solutions such as Optimism , Arbitrum or Polygon are still many times cheaper than transactions on the Ethereum network itself.

The energy required to keep cryptocurrency networks running has been a major criticism for years. The Bitcoin network, according to Cointelegraph, uses around 0.15% of the world's total energy consumption. This is a significant amount of energy, especially in an energy crisis. Since the merge, this criticism no longer applies to Ethereum's network. In fact, the PoS network requires a lot less less energy. Since the merge, more than 99% less energy is needed to run the network. Security is now based on capital (the stake) rather than the computer power required.

Issuing and burning of ETH

To reward the validation of transactions, the validators (first the miners) receive Ether as a reward. Before the merge, the miners were paid about 4,930,000 ETH per year as a reward for securing the network. This amounts to about 13,500 ETH per day or 2.08 ETH every 13.3 seconds. This resulted in an inflation rate of about 4% per year. With the current proof of stake mechanism, based on a 14 million ETH stake, about 620,00 ETH extra comes into circulation per year to reward validators. This is a significant drop in the number of extra Ether coming into circulation per year.

Besides the rewards, there is - since the implementation of the EIP-1559 - a burn mechanism for Ether. Here, part of the transaction fees are burnt and thus removed from circulation. The number of coins burned depends on the activity on the network. The more the network is used, the more Ether is burnt. So more will usually be burnt in a bull market than in a bear market since the activity on the network is higher in a bull market.

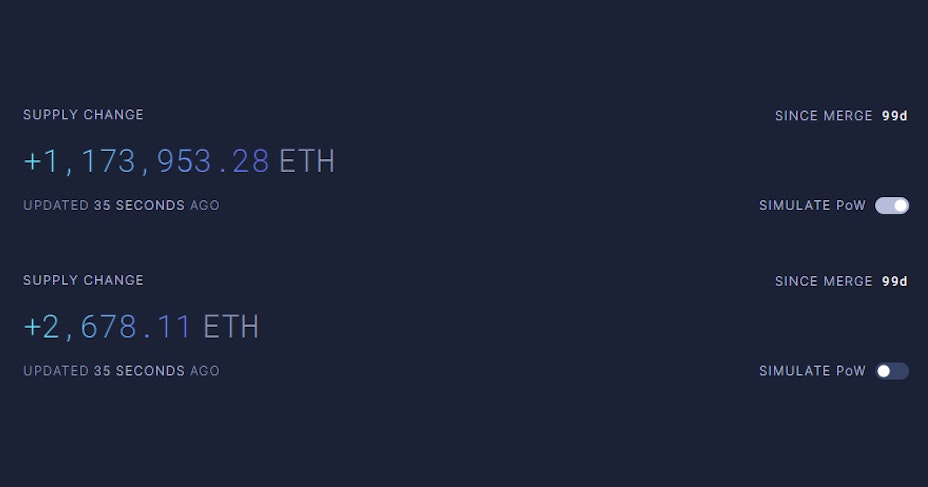

Ultrasoundmoney collects data from the Ethereum blockchain and makes it insightful. This shows that the combination of proof of stake and the EIP-1559 mechanism has a major impact on the (new) supply of Ether. Whereas with proof of stake only 2678 ETH were added to the supply in 100 days (since the merge), with proof of work it had been more than 1.1 million. This is at the current Ether price of $1200 almost $1.5 billion of potential selling pressure on the market. It is therefore plausible that this has had an impact on the price: if Ethereum had not moved to proof of stake, the price could have been significantly lower.

Activity on the Ethereum network

In our recent blog on Cardano , we discussed in detail the topic of Total Value Locked (TVL). The TVL includes all kinds of DeFi activity such as lending, liquidity pools and staking. Each network has its own TVL. This is a good indicator of the size of the ecosystem and hence activity. Since the amount of activity has a size impact on the price of Ether (ETH) (due to, among other things, the Ether required to participate in DeFi activities, for transaction costs and the amount of coins burned), it is important to keep an eye on the TVL for a price analysis.

Ethereum has by far the highest TVL. At the time of writing, it is approximately $23.5 billion. However, at its peak in the bull market, it was much higher; peaking at over $110 billion. Since the TVL depends on the coins that are on the Ethereum network, and these coins have sometimes fallen by more than 90%, it is not surprising that the TVL is significantly lower than when measured at market valuations in the bull market. Although this TVL also includes stablecoins on the Ethereum network.

Ultrasoundmoney also provides a tool to see which DApps have contributed the most to activity on the network and thus caused Ether to burn. This data does not go back to the merge, but goes back to the implementation of the burn mechanism EIP-1559 about 1.5 years ago. From this data, we see that Uniswap (V2 & V3) has made a large contribution to the burned ETH of over 300,000 ETH. Besides Uniswap, the NFT hype has also led to a large demand for ETH. OpenSea has also ensured that more than 300,000 ETH has been burnt by using their platform. Besides NFTs, the stablecoins UDST and USDC have caused a lot of activity and collectively burnt more than 170,000 ETH.

Statistics on activity on the network:

- 6000 decentralised apps (DApps) active on the network including MakerDAO, Curve, Uniswap and AAVE

- 71 million wallets have Ethereum in their wallets

- Over 1 million daily transactions including 12 per second

- Ether (ETH) transaction volume of more than 800,000 transactions

- ERC-20 transaction volume of more than 600,000 transactions

- ERC-721 transaction volume of more than 300,000 transactions

- More than 2,700,000 ETH has been burnt since the burn implementation

Ethereum Roadmap

Ethereum's vision is to make the network mainstream so that hundreds of millions of people can use it. To do this, however, it needs to be scalable, secure and sustainable. This is therefore the vision of the developers behind Ethereum. Thousands of transactions per second should be able to take place at low cost, no one should be able to attack the network and the energy required should be minimal. While the latter has already been completed by moving to proof of stake, the other two are still under discussion. Therefore, we now look at the roadmap for Ethereum.

- Phase 0 The Beacon Chain (implemented): Introduced the Proof-of-Stake ecosystem.

- Phase 1 The Merge (implemented): The transition from Proof-of-Work to Proof-of-Stake.

- Phase 1 Shard Chains: Divides the blockchain into multiple shard-chains, each dedicated to a specific task.

Shanghai Update

The Shanghai upgrade is scheduled for March 2023. This Shanghai update will include several Ethereum Improvement Proposals (EIP). While most updates tend to be bullish in the crypto market, that is not really the case with this update. Ahead of the merge, holders of Ether were already able to stake their coins on the new network (the beacon chain). In exchange for this stake, which had to be a minimum value of 32 Ether, stakers received rewards. Starting the stake was possible months before the merge. However, unstaking was not possible until the Shanghai upgrade.

Meanwhile, the amount of ETH tied up in the stake contract has risen nicely. At the time of writing, it is over 15.7 million ETH according to Etherscan . At a price of $1200 per ETH, this is more than $18,840,000,000. If this quantity comes on the market at once and can be sold, it could have a very negative impact on the price. Although it is to be expected that some of these investors have hedged their price risk, it could still create selling pressure. So this update will be a moment that many investors are watching with suspicion.

What is sharding?

Sharding is horizontal splicing of a database allowing the load of data to be distributed. This will reduce congestion on the network and allow for a higher number of transactions per second (TPS). In addition, sharding will make transactions cheaper. Layer 2 solutions can take advantage of sharding and offer lower transaction costs while still maintaining the security of the Ethereum network.

Decentralisation can also be increased by sharding. Indeed, anyone can then run a node which helps ensure decentralisation. There is no more need for valuable and powerful hardware to run a node after sharding updates. Hence, more participation to the network can be expected which increases network security.

Sharding is one of the biggest updates coming to the Ethereum network and should increase scalability and capacity. Sharding is expected to be rolled out in 2023 or 2024. This, just like the transition to proof of stake, will happen in several phases. Vitalik previously expressed the following about sharding: "Imagine that Ethereum has been split into thousands of islands. Each island can do its own thing. Each of the island has its own unique features and everyone belonging on that island i.e., the accounts, can interact with each other AND they can freely indulge in all its features. If they want to contact with other islands, they will have to use some sort of protocol."

The Surge, Scourge, Verge, Purge & Splurge

The Surge should ensure that more than 100,000 transactions per second can be done on the network of Ethereum Rollups worries. With this comes all sorts of Ethereum Improvement proposals (EIP).

After the merge, Ethereum may have more censorship and centralisation due to certain parties having a large portion of staked Ether under their staking pool. More and more of these parties are cooperating with the Office of Foreign Assets Control (OFAC). This is something that goes against the ethos of crypto-currencies and which Vitalik therefore wants to prevent. The Scourge should be part of the roadmap in which this should be prevented.

The Verge will aim to make verifying blocks easy. It should be possible for anyone to do this with a few computer calculations using small data requirements. This is one of the goals to make Ethereum mainstream.

The Purge aims to wipe the protocol clean. This will allow technical aspects that are no longer needed to be removed from the protocol. Old history that is no longer needed will also be removed. This will reduce the necessities required to participate which will make participating in the network easier.

Finally, Splurge is scheduled to update the network. This update is still a bit vague, but aims to fix every last thing. Again, all kinds of EIPs will be involved. But also other things like specialised hardware. After this, Ethereum should be 'done'.

Ethereum's price history

The Ethereum price experienced a tremendous bull run during 2017 and 2018. After that, the Ethereum price gradually consolidated and rose steadily until 2021. In 2021, almost all cryptocurrencies exploded exponentially and several all-time-highs were broken. Subsequently, all prices dropped again. This was also the case with Ethereum. Still, sometimes it is good to zoom out and take a look at the bigger picture. To look at the whole perspective, we will now compare Ethereum price trends over the years. We will do so by comparing the all-time-highs and all-time-lows of these years.

Ethereum price 2016: Lowest - €0.0863 / Highest - €18.26

Ethereum price 2017: Lowest - €7.67 / Highest - €701.10

Ethereum price 2018: Lowest - € 74.09 / Highest - € 1,187.08

Ethereum price 2019: Lowest - € 91.47 / Highest - € 296.59

Ethereum price 2020: Lowest - € 98.88 / Highest - € 612.10

Ethereum price 2021: Lowest - € 604.66 / Highest - € 4,192

Ethereum price 2022: Lowest - €946.46 / Highest - €3,327

Ethereum price 2023: Lowest - €1,137 / Highest - €3,720

Fidelity

In October 2022, Fidelity - a multinational financial services company - made Ethereum available for investors to trade in. As a result, institutional parties can now trade Ethereum at Fidelity. The multinational manages more than $4.5 trillion in assets. Although Fidelity says investors are currently paying attention to other assets, it is still an important milestone. 'Investors are still waiting for clear laws and regulations in the crypto domain,' Ric Edelman states in Forbes.

This availability to institutional parties could be the next big thing in the crypto domain in the coming years. With the large amounts of money under management at Fidelity, a very small percentage of this could already cause major price movements. Whether institutional parties will actually allocate capital to Ethereum through Fidelity remains to be seen. Still, the digital assets branch at the company plans to increase its headcount by around 25% within six months.

Could Ethereum reach $50,000?

Based on a prediction by research-driven performance analytics firm VanEck, Ethereum (ETH) has the potential to skyrocket to $51,000 by 2030 if another crypto bull market occurs. This prediction depends only on the extent to which Ethereum (ETH) is embraced by various industry sectors, including finance, healthcare and insurance. Ethereum (ETH) could become the largest and provide large portion of business activities in various sectors its many benefits.

Overall, VanEck predicts a base case price of more than $11,000 for Ethereum (ETH), offering significant potential returns for long-term investors. Ethereum (ETH) is already trading at $3500 after starting the year at just $2100, representing a gain of more than 60% since the beginning of the year.

So according to VanEck's prediction, Ethereum could be worth $51,000 by 2030; in the short term, this is almost impossible. Still, in this volatile cryptocurrency market it is very unwise to rely only on predictions, therefore always do further research and think about your decisions.

Realistic predictions

The content on this page, including all cryptocurrency price predictions, is provided solely for informational purposes and is not intended as financial or investment advice. Cryptocurrency markets exhibit cyclical patterns characterized by bull runs, where optimism and substantial investments can lead to significant price increases, and bear markets, where prices of even the most stable cryptocurrencies might plummet by 80-90%. While analysts and firms like DigitalCoinPrice may project continual market growth driven by persistent optimism and investment, the cryptocurrency landscape is inherently volatile and can change abruptly. Investors should not solely rely on the notion of uninterrupted growth but should also be aware of potential risks and market volatility. Predictions are therefore only made for projects with a substantial historical presence to ensure a more informed analysis. Always conduct your own research before making any investment decisions. Past performance is not indicative of future results.

Conclusion

In the coming years, prediction for Ethereum is positive. Factors such as the adoption of Bitcoin ETFs, the transition to Proof of Stake, and increasing activity on the Ethereum network add to the optimism. Although price predictions are risky, forecasts show steady growth in Ethereum's price through 2030. Ethereum's continued development and expansion of its ecosystem make for an exciting future, but investors should always be mindful of crypto market volatility.

Other price predictions

- Bitcoin price prediction

- Ripple price prediction

- Dogecoin price prediction

- Cardano price prediction

- Solana price prediction

- VeChain price prediction

- Litecoin price prediction

- Ethereum Classic price prediction

- Axie Infinity price prediction

- Arbitrum price prediction

- Uniswap price prediction

- Shiba Inu price prediction

- Binance Coin price prediction

- Enjin Coin price prediction